Home

Social Security Benefits

Posted By: Chamacat

Social Security Benefits - 05/13/18 04:46 PM

Yep..Last week I was out at a camp with an older gentlemen. After supper we were talking and he was telling me that he was going to wait until he is 66 or so years of age before he applies. I asked him why he would pass on 48 months of benefits to get to 66. He said that he planned on living longer than 66. If you ask me it would take quite awhile to make up for the benefits you left on the table until the maxium benefit amount would be reached at 66. Wouldn't it be smart money to go ahead and get the benefits at 62?

Posted By: T-Rex

Re: Social Security Benefits - 05/13/18 04:52 PM

My accountant told me I'd need to live to 85 to make up the difference from taking the earliest retirement.

Posted By: kytrapper

Re: Social Security Benefits - 05/13/18 04:52 PM

In my simple mind, yes.

Posted By: hippie

Re: Social Security Benefits - 05/13/18 04:52 PM

We figured so.

Wife has an appt. tomorrow to sign up. When we went up months ago, the lady showed us the difference and we decided to go at 62.

Posted By: wissmiss

Re: Social Security Benefits - 05/13/18 04:53 PM

If you start taking SS before your full retirement age (probably 66 in this guys case), there are deductions in what you get if you are still working. Not sure of the details but your SS check is reduced.

If you wait til full retirement age, you can earn as much as you want and still get your full benefit. That is why I waited.

Posted By: hippie

Re: Social Security Benefits - 05/13/18 04:53 PM

My accountant told me I'd need to live to 85 to make up the difference from taking the earliest retirement.

This is what we figured with the numbers the lady showed us.

Posted By: Law Dog

Re: Social Security Benefits - 05/13/18 04:58 PM

He is giving up $54,000 by waiting it will take him 18 years to benefit from the time he waited to see the 1st dollar, tell him good luck and thanks! Nobody plans to die sooner but many do.

Posted By: T-Rex

Re: Social Security Benefits - 05/13/18 04:59 PM

You can still earn limited income without penalty. After that limit, you are taxed. So what? It is entirely controllable.

BTW, I did take the early retirement, and am still working. Now that I am over the full retirement age, there is no limit to what I can earn without affecting my SS benefit.

The flip side:

My SIL is a CPA. she decided to wait for full retirement age. Although her health ain't that great right now, she is banking on a nice long life. WTH, the mid sixties ain't nearly as old as it was when SS was established.

Posted By: Paul Dobbins

Re: Social Security Benefits - 05/13/18 05:36 PM

Back when I was 62 I looked at drawing SS. I found out that for every two dollars I made over $14,700 they would take one dollar from my benefit. It would have left me with no SS. So I started drawing at 66 and there's no limit on how much I can make and still get the full benefit.

Posted By: Chamacat

Re: Social Security Benefits - 05/13/18 05:49 PM

Yep..That $14,700 dollars does that include 401K's?

Posted By: hippie

Re: Social Security Benefits - 05/13/18 05:53 PM

If your gonna keep working regardless, no reason to draw early?

I'm talking actually retiring.

Posted By: Sullivan K

Re: Social Security Benefits - 05/13/18 05:55 PM

Yep..That $14,700 dollars does that include 401K's?

No, it's only earned income. But, your SS does get taxed if your income exceeds a certain amount. I have some Municipal bonds that are state and federal tax free. But in figuring taxes on SS that bond income is figured in. So even though the bonds are tax free they cause my SS to be taxed. Go figure that one out.

I quit working at 61Ĺ. I started drawing SS at 62 and 1 month. My break even point is 77 years and 11 months old. When I quit working I had no intention of working, at a paying job, again, so the reduction in benefits, if I earned a certain amount of money, did not factor in. The males in my family do not live to be very old, so I decided to figure I also was not going to live to be very old, and I might as well try to get as much of my SS as I could.

Posted By: ratbrain

Re: Social Security Benefits - 05/13/18 06:13 PM

I starting drawing at 62. No regrets.

Posted By: Bob Jameson

Re: Social Security Benefits - 05/13/18 06:31 PM

I also waited until 66 to receive benefits. If I had taken it at 62 1/2 years of age I would have had a limit on my income and would have to pay it back over a certain amount.

If you don't have any other income you may be further ahead. I have two businesses and it would have cost me money to take it early so I opted to wait until 66.

It was the best decision. Now it is all mine with no threat of having to pay any money back to Uncle Sam.

Posted By: wissmiss

Re: Social Security Benefits - 05/13/18 06:37 PM

Each persons situation is different. What worked for me won't necessarily work for some one else.

There are calculators on the SS web site that you can pull up your account and plug in numbers for different scenarios and see which is best for you. Do your research before making a decision.

Posted By: BFP

Re: Social Security Benefits - 05/13/18 06:38 PM

I started drawing at 62, The only mistake I made was I should've started 40 yrs. sooner.

Posted By: GritGuy

Re: Social Security Benefits - 05/13/18 06:45 PM

I take mine next year at 66 full check, no penalty to keep working either. Sign up for Medicare this year, drops the wivery's insurance cost down for her program as well.

Made no sense to me to take it early, suffer a penalty while you keep working and lose funds.

This way I made more for waiting till my full retirement age, Utah is one of 14 other states that taxes your SS funds any way, so I don't need more penalty on top of taking it early, your Medicare health funds come out of it as well, so the longer you wait the better check you have.

Only time it makes sense to take it early is if your failing in your health or you don't have the genes for long life. You actually make out just about even in the end any way as your SS is adjusted when you turn 70 to make up the difference.

Don't know why people continue to not study up on SS and Medicare, both are what you been paying for since your started working !!

Posted By: hippie

Re: Social Security Benefits - 05/13/18 07:17 PM

I take mine next year at 66 full check, no penalty to keep working either. Sign up for Medicare this year, drops the wivery's insurance cost down for her program as well.

Made no sense to me to take it early, suffer a penalty while you keep working and lose funds.

This way I made more for waiting till my full retirement age, Utah is one of 14 other states that taxes your SS funds any way, so I don't need more penalty on top of taking it early, your Medicare health funds come out of it as well, so the longer you wait the better check you have.

Only time it makes sense to take it early is if your failing in your health or you don't have the genes for long life. You actually make out just about even in the end any way as your SS is adjusted when you turn 70 to make up the difference.

Don't know why people continue to not study up on SS and Medicare, both are what you been paying for since your started working !!

Allow me to throw an "unless" in here.

Makes no sense to retire early,

"Unless"

Your not figuring to continue working and actually retiring.

I agreee with ya if as you stated, your going to keep working anyhow.

Like someone said, every situation is different, working or not. Health has alot to do with it also.

Posted By: newtoga

Re: Social Security Benefits - 05/13/18 07:27 PM

Will get my 4 this check weíd this week. Started at 62. As previously stated go till 85 to make up the difference.

Posted By: Furvor

Re: Social Security Benefits - 05/13/18 07:30 PM

You can still earn limited income without penalty. After that limit, you are taxed. So what? It is entirely controllable.

The limit and percent of SS taxed is based on household income, not just your personal income.

I wrote to the president about this penalty for working but it did no good.

Posted By: GritGuy

Re: Social Security Benefits - 05/13/18 07:43 PM

Hippie

Makes no sense to retire early,

"Unless"

Your not figuring to continue working and actually retiring.

Yea thats true if your not wanting a full check and don't complain about not getting your full worth out of what you have put into it !

I'd like to get as much as I have put into it while still being able to work, and use it to help offset what kind of goofy health program that comes up next, however I'm not waiting until 70 to help congress stave off what they created in it dieing out !!

Posted By: hippie

Re: Social Security Benefits - 05/13/18 07:47 PM

Hippie

Makes no sense to retire early,

"Unless"

Your not figuring to continue working and actually retiring.

Yea thats true if your not wanting a full check and don't complain about not getting your full worth out of what you have put into it !

I'd like to get as much as I have put into it while still being able to work, and use it to help offset what kind of goofy health program that comes up next, however I'm not waiting until 70 to help congress stave off what they created in it dieing out !!

I hear ya.

That's what we're talking about, getting the most out.

For most, taking it at 67 you'd have to live to 85 to break even of a fella taking it at 62.

Our full is at 70, at 67 we still take a deduction.

Posted By: Hal

Re: Social Security Benefits - 05/13/18 08:12 PM

My accountant told me I'd need to live to 85 to make up the difference from taking the earliest retirement.

I would

quickly seek out another accountant!

I've run the numbers on this several times, and I'm waiting until I'm 70 to draw SS. I only have to live to be 78 to "catch up" on all the reductions from drawing at 62 or 66. I'm convinced that I will indeed live to be 78. After that, it's all gravy. Big check every month.

Posted By: bblwi

Re: Social Security Benefits - 05/13/18 08:19 PM

You don't max out until age 70, and some wait that long. Much depends upon how much you want and need for monthly income and how much other earned income you may or may not have.

I did not take SSN until after I was 66 years old, one year after Medicare. I took a part time job after retiring at age 60 and held that for over 5 years I would have paid back about half so why? More importantly I got an 8% increase per year for waiting 4 years. This was during a time when where I worked we got wage freezes or 3% cuts. Those SSN increases per year were the biggest increases in annual pay I ever received. Also my wife who was at the minimum got a good boost by me waiting until I received the larger amount. It is not always the max dollars one looks at but what the amounts are for a lifetime when all other aspects are considered.

Bryce

Posted By: NonPCfed

Re: Social Security Benefits - 05/13/18 08:22 PM

We're trying to get the wwife to 62 so she can collect. She is a RN and those 13 hour hospital shifts with her diabetes andd other aliments are are getting to be a major bugger besides the health system trying to get rid of their highest paid help (not management of course!). I'm a year and half younger than her so I figure I'll go at 63, the endd of 2025 sounds like a good year to tell the man, "see ya later". I may not draw right-of-away, have to see how our 401ks are doing and if we're still in this house. But I'm sure as he** not waiting until I'm 70, either in my job or taking my SS allotment. Not if I want to spent much time with the wife or getting around before I'm too gimped up. I'll adjust my lifestyle first, already have to a certain extent. There's a lot of stuff that I thought might be neat to do when I was younger that I've realized I'm not probably going to do. I'm ok with that. Surprisingly, the desire to ddo most of those things has decreased as well. No real regrets. Constantly pining and whining about what could have been is a waste of time...

Posted By: Hal

Re: Social Security Benefits - 05/13/18 08:26 PM

Obviously, the concept of delayed gratification is foreign to most folks.

Posted By: Boco

Re: Social Security Benefits - 05/13/18 08:38 PM

I took mine(CPP) at 60.Was only a couple hundred difference if I waited til 65.We get another one(OAP) at 65 anyway.

Posted By: Chamacat

Re: Social Security Benefits - 05/13/18 09:03 PM

Yep..I been looking around likes been suggested. I see where some states are better places to be in for state taxes on social security benefits. The question I'm going to throw out there is there federal income tax withheld no matter what state one lives in? I don't see any schedule for that.

Posted By: Sullivan K

Re: Social Security Benefits - 05/13/18 09:26 PM

The question I'm going to throw out there is there federal income tax withheld no matter what state one lives in? .

I live in Ohio and I have no withholding taken from my SS. I just pony up when I file my taxes.

Posted By: GritGuy

Re: Social Security Benefits - 05/13/18 09:49 PM

Great question about the fed tax and state tax for that matter, not having been through this I'd assume those who have to pay would have to just save up for it. I will do some more research and find out if it's coming out or not, however due to still working I'd assume it's up to the receiver to pay when it's due. Might be different if one is not working and everything is all set with no changes in income.

I plan on putting a bit aside every check just like it being taken out to pay when it's due, another bite out of the SS check LOL, by the time it's all said and done one should have enough for gas money to keep going to work !!

Posted By: T-Rex

Re: Social Security Benefits - 05/13/18 10:15 PM

My accountant told me I'd need to live to 85 to make up the difference from taking the earliest retirement.

I would

quickly seek out another accountant!

I've run the numbers on this several times, and I'm waiting until I'm 70 to draw SS. I only have to live to be 78 to "catch up" on all the reductions from drawing at 62 or 66. I'm convinced that I will indeed live to be 78. After that, it's all gravy. Big check every month.

There ain't no way I'd drop a life long friend and fraternity brother over good advise that you will never understand. Finances are a lot more complex than some folks will ever understand. Your numbers and my numbers probably have nothing in common.

Posted By: bblwi

Re: Social Security Benefits - 05/13/18 10:20 PM

There no federal withholdings or state witholdings for SSN. Your amount of tax on your SSN income is based on your AGI. Some states don't tax SSN at all, some do so you need to review all those differences as well.

Bryce

Posted By: Law Dog

Re: Social Security Benefits - 05/13/18 10:26 PM

Some of you guys should look up the word retirement maybe! Just saying if you collect retirement and keep on working your not really "retired" are you? If a guy retires and collects SS and works some small jobs life can be good sure you make a little less but your costs are way less too.

Posted By: GritGuy

Re: Social Security Benefits - 05/13/18 10:30 PM

Bryce, one can have estimated with holding taken out of a SS check in a state that does tax this income. This is for state taxes only as far as I can research it out yet. Fed's have not been so easily defined on what they will do.

Yes it is based on your AGI, however if your still working like I am when taking my SS check it might be easier to have an estimated tax taken out than trying to save all year long for it. Especially if your not knowing if your going to be working a lot of overtime or not. It's just a guess on the form with 4 or five amounts though, it is not a real figure so saving may come into play but not at such a large rate.

Getting the SS check just plain and simple seems to be evading me as I do more research on it !!

Gonna retire at 62 1/2 and live off a pension and 401K....Will start drawing SS at 70 so my wife's half will be larger after I'm pushing up daisies.

Posted By: Sullivan K

Re: Social Security Benefits - 05/13/18 10:42 PM

Fed's have not been so easily defined on what they will do.

Getting the SS check just plain and simple seems to be evading me as I do more research on it !!

When I signed up for SS I was asked if I wanted any withholding. I told them no. If you want to change you can file Form W-4V.

I'm not sure, but I don't believe you get an SS check. I think it is all direct deposit now and it was very simple. I just gave them the account number I wanted the money to go into.

Posted By: Chamacat

Re: Social Security Benefits - 05/13/18 10:49 PM

Yep.So does the federal government from the Social Security Administration. Send out a 1099 form? or something close to it?

Posted By: Sullivan K

Re: Social Security Benefits - 05/13/18 10:50 PM

Yep.So does the federal government from the Social Security Administration. Send out a 1099 form? or something close to it?

Yes

Posted By: Chamacat

Re: Social Security Benefits - 05/13/18 10:59 PM

Yep..Everything I have been reading today may not be accurate information. I can't tell if the new tax laws/code that have been imposed impacted Social Security Benefits payouts. I don't think they did.

Posted By: T-Rex

Re: Social Security Benefits - 05/13/18 11:04 PM

Retirement means a lot of different things to different people. It is a relatively new concept, less that 100 years old. The creator intended people to work as long as they lived, and that is what I intend to do. The US Government, on the other hand decided that it ought to get old folks out of the workforce to make room for younger workers. And why not, when they could double up that idea with a new tax grab.

My idea of retirement, has nothing to do with sitting on a Lazy Boy, or under a palm tree. It is more a time where I can slow down just a bit, by reclaiming what the government has been stealing from me over my "working" years.

Posted By: Sullivan K

Re: Social Security Benefits - 05/13/18 11:15 PM

Retirement means a lot of different things to different people.

Since I retired, in 2013, I have been busier than heck, and not earned one cent. As has been said by other retired people "Since I retired I don't know how I ever had time to work." With everything I do now, I don't know how I had time to do everything else I do now, while I was working.

Posted By: Chamacat

Re: Social Security Benefits - 05/13/18 11:22 PM

Yep..The way I see it you only have one shot at it. It will be one of the most important shots one makes entering the fall and winter of ones life. Deciding when to pull the trigger

Posted By: bblwi

Re: Social Security Benefits - 05/13/18 11:32 PM

You can have them deduct monies for your taxes monthly if you choose to but I keep a reserve and pay at the end. Some of the investments I have had have gained double digit returns in months so why would I let the government use those funds when I could be gaining earnings?

Sometimes also a tax payer is required to file quarterly due to how one's income is structured or the types of incomes one has. I am looking at that potential now that I am at the age of RMD's. I am strongly considering taking out far more than I need the next 7 years before we go back to the higher rates etc.

Bryce

Posted By: Law Dog

Re: Social Security Benefits - 05/13/18 11:44 PM

I get SS and State retirement and work on call for the Sheriff's Dept when needed mostly transports and some Court duty stuff. Between some farm work, skunk trapping and making cages the income is at what I was making before with out the crazy hours.

Just have a plan own nobody if you can and life is a lot easier that way! Retirement is not doing nothing trust me you get more work done when works not getting in the way.

Posted By: Sullivan K

Re: Social Security Benefits - 05/13/18 11:50 PM

you get more work done when works not getting in the way.

That's exactly what I was trying to say

Posted By: snowy

Re: Social Security Benefits - 05/13/18 11:59 PM

I get SS and State retirement and work on call for the Sheriff's Dept when needed mostly transports and some Court duty stuff. Between some farm work, skunk trapping and making cages the income is at what I was making before with out the crazy hours.

Just have a plan own nobody if you can and life is a lot easier that way! Retirement is not doing nothing trust me you get more work done when works not getting in the way.

I'm retired but not old enough for SS yet. I will take it at 62 not waiting around to see who wins the game. My break even year is 84 and there is no guarantee I will be around at 84. Why would I want more SS money when I'm old I would rather have less and have it while I am younger and can use it better then being in my 80's. No right way or wrong way ever case is different.

Posted By: Sullivan K

Re: Social Security Benefits - 05/14/18 12:03 AM

I see all these 85--84 year break even points. I don't understand. My break even point is 77 years 11 months. That's a big difference.

Posted By: bblwi

Re: Social Security Benefits - 05/14/18 12:15 AM

For me waiting each additional year was 8% increase in monthly payment by waiting. Now take a look at how large, small or none at all increases SSN is likely to give out over the next years, decades etc. and one can quickly see that waiting at least for me significantly increased lifetime benefits. We can all play the odds and figure what will be best but the most important thing I feel we did in our family is invest from day one on my first job and not have to take resources quickly if waiting made good sense. I retired the first time in 2006 mid year. I am so glad I took the job and did not have to pull money out of my retirement accounts when they had fallen 40%. The part time job allowed me to get through that down patch and also withstand the 26% cut we took in our pension spread out over 5 years.

Bryce

Posted By: Fishdog One

Re: Social Security Benefits - 05/14/18 12:16 AM

I retired last year at 62 and will not take SS till I need it, trying to live on as little as possible, pull money out of CD's when we need to. My deal is a disabled wife who does not have the 40 quarters of work record to get SS or Social Security Disability, every cost has always been up to us to pay after insurance. Last couple of years we had over $5000 out of pocket so I said screw it and just quit working, I will take care of her. If I take the smaller SS and die her spousal benefit at 62.5 would be 35% of mine and would stay at that because she has no SS of her own. So we will try to make it to 66 without taking SS.

Posted By: nightstalker1

Re: Social Security Benefits - 05/14/18 12:23 AM

My break even is 78

I'm taking SS at 62

Everybody's situation is different...pension , 401K , etc

I also factored in quality of life in my decision

My thoughts are that I'll be more active and make better use of the SS money from 62-66

than after I turn 78

I just don't think I'll be able to do as much after 78 as compared to 62-66

Posted By: snowy

Re: Social Security Benefits - 05/14/18 12:23 AM

I see all these 85--84 year break even points. I don't understand. My break even point is 77 years 11 months. That's a big difference.

Monthly Social Security benefits

Retirement age

Break-even age

$2,102

62 vs. 66

Between 77 and 78

$2,806

62 vs. 70

Between 80 and 81

$3,721

66 vs. 70

Between 82 and 83

Now this is just a example and these ages go up for break even age from the amount you receive, expenses, returns etc.

Posted By: Sullivan K

Re: Social Security Benefits - 05/14/18 12:30 AM

I see all these 85--84 year break even points. I don't understand. My break even point is 77 years 11 months. That's a big difference.

Monthly Social Security benefits

Retirement age

Break-even age

$2,102

62 vs. 66

Between 77 and 78

That is exactly where I am at. None of those numbers say the break even age is above 83, yet people keep quoting 84 to 85

Posted By: charles

Re: Social Security Benefits - 05/14/18 12:38 AM

We waited until 70. Get an 8% increase in future benefits each year we wait. Was fortunate not to need it or retirement account (age 70 1/2) until latest possible dates. Wife will spend money like its water. Best to shield it from her.

Posted By: Law Dog

Re: Social Security Benefits - 05/14/18 12:42 AM

The confusion is it's the "difference" not the "total" you need to figure into the 18 year formulas! At 66 your getting more yes but you would be getting that $1,060.00 already at 62 so the $54,000+ is what you need to make up in the difference what you would of been getting VS the higher rate if you wait. The "base" has always been there so the difference is what the formula applies to.

Posted By: GritGuy

Re: Social Security Benefits - 05/14/18 12:48 AM

Keith, your correct in there is no check it is direct deposit, I was simply using the check word as description.

I don't get how these people are getting their break even numbers that high either, they must not figure in the automatic adjustments that SS does when you get older to make up for taking it a 62. My boy's Father in law got a single large make up check for taking his and bringing it up to what it's supposed to be when he signed up after waiting till 68, when he got divorced, when he could have taken it at 65. So there are ways of bringing it current to catch up.

Is not worth it to me to wait till 70 to start using it, to much talk of to much change in the program has me nervous about losing what I have coming or even waiting longer until I get to start taking it after already waiting past 62.

I can understand those taking it at 62, but I was still working full bore and had lots of OT helping out those years for making my SS larger, they only use 35 of your best years to designate your income. So the last eight have really changed my amount coming due to such a high income, sorta defeats the purpose for me of waiting till 70.

Each one does have their own way of living thank the lord for that and the country we live in !!

Posted By: Law Dog

Re: Social Security Benefits - 05/14/18 12:53 AM

Just keep in mind that the guy that works 40 quarters and the guy that works 120 quarters get the same "checks", the guy that gets on SSI get the higher amount even if he gets on at 25 years of age! If I read that right.

Posted By: GritGuy

Re: Social Security Benefits - 05/14/18 01:02 AM

Don't think thats correct LAW, as I know people who have done just that and are getting different amount checks, it's based on your income in those quarters.

You only need 35 quarters to qualify, your income is based on the highest of those 35, whether or not you worked 40 35 or 125, but most work longer than that before getting their first SS deposit, your income from SS still continues to change as you continue to work, provided that those years change any prior years that are lower, if not then its a sixer and usually will stay the same except for government mandated cost of living raise's.

According to this SS booklet I have here, and the Medicare brother it shares, LOL

Posted By: Chamacat

Re: Social Security Benefits - 05/14/18 01:28 AM

Yep..for numbers sake..If a guy retires at 62 and gets 1700.00 a month (early retirement). He takes that amount each month for 52 months (which makes his age 66.4 years old) he will be $88,400 dollars ahead in 4 years 4 months.

So if he waits till 66.4 years for his first check and it's $2300.00 how many years will it take to make up the $88,400 dollars?

If That same guy waited until he was at age 70 and gave up 96 months at $1700. he would have left $163,200 dollars on the table..thus making this cat an old old cogger making up that kind of cash

Posted By: hippie

Re: Social Security Benefits - 05/14/18 02:02 AM

Using those numbers Chamacat, i get it would take you 12.2 years to break even.

(Your 62 to 66.4 numbers)

Posted By: hippie

Re: Social Security Benefits - 05/14/18 02:06 AM

Mine is different from the wifes because i have another 6 years to wait and i don't gain as much per year worked over 62.

She gains alittle less than 100 more per month for every year over 62 that she works up to 70. I won't gain that much.

Posted By: Chamacat

Re: Social Security Benefits - 05/14/18 02:14 AM

Using those numbers Chamacat, i get it would take you 12.2 years to break even.

(Your 62 to 66.4 numbers)

Thanks..I see how you did that..If the guy waited till he was 70 at the same numbers it would be at 22.6 years break even..that would make him around 88.5 years old..

Posted By: ebsurveyor

Re: Social Security Benefits - 05/14/18 02:23 AM

If you start taking SS before your full retirement age (probably 66 in this guys case), there are deductions in what you get if you are still working. Not sure of the details but your SS check is reduced.

If you wait til full retirement age, you can earn as much as you want and still get your full benefit. That is why I waited.

I did not read all of the posts, but will add my comments after reading the one I quoted. For me 66 was the age that my SS Benefit would not be reduced IF I EARNED INCOME. In short if I collected at age 62 and continue to work my SS Benefit would be reduced. I think at about $35,000 my SS Benefit would be reduced to $0.00 if I started collection SS at 62. At age 66 I could earn as much income as I could and my SS Benefit would no be reduced. So..... if you are just going to collect SS and NOT EARN INCOME I would collect as soon as possible. If you are going to collect SS and continue to EARN INCOME you better wait until the magic age for your age group.

Go here and look it up:

https://www.ssa.gov/benefits/retirement/

Posted By: Law Dog

Re: Social Security Benefits - 05/14/18 02:42 AM

Don't think thats correct LAW, as I know people who have done just that and are getting different amount checks, it's based on your income in those quarters.

You only need 35 quarters to qualify, your income is based on the highest of those 35, whether or not you worked 40 35 or 125, but most work longer than that before getting their first SS deposit, your income from SS still continues to change as you continue to work, provided that those years change any prior years that are lower, if not then its a sixer and usually will stay the same except for government mandated cost of living raise's.

According to this SS booklet I have here, and the Medicare brother it shares, LOL

Anybody get more then $1,160 a month at 62?

Posted By: ebsurveyor

Re: Social Security Benefits - 05/14/18 02:45 AM

Yep..I been looking around likes been suggested. I see where some states are better places to be in for state taxes on social security benefits. The question I'm going to throw out there is there federal income tax withheld no matter what state one lives in? I don't see any schedule for that.

You will need to pay federal income tax on your SS Benefit. It is optional to have income tax withheld. I have been collecting for almost 6 years and just recently have gotten back more than I put in. I still work and must continue to pay in. Both me and my employer are paying in about $8000, total $16,000 per year. I have not run the numbers but even starting at age 66 and continuing to work it is doubtful that I can live long enough to collect what me and my employers have put into the system. I think my current breakeven point is age 87.

Oh yes, they even give raises to the amount you collect. We got an increase for 2018 and my monthly benefit is $22 less than it was in 2017. It seems like every time I get an increase they also increase the amount they TAKE for Medicare.

Posted By: ebsurveyor

Re: Social Security Benefits - 05/14/18 02:50 AM

Yep.So does the federal government from the Social Security Administration. Send out a 1099 form? or something close to it?

They sure do send out a 1099SSA, I think it's called. They want their fare share and some states also want their share.

Posted By: Chamacat

Re: Social Security Benefits - 05/14/18 02:54 AM

Don't think thats correct LAW, as I know people who have done just that and are getting different amount checks, it's based on your income in those quarters.

You only need 35 quarters to qualify, your income is based on the highest of those 35, whether or not you worked 40 35 or 125, but most work longer than that before getting their first SS deposit, your income from SS still continues to change as you continue to work, provided that those years change any prior years that are lower, if not then its a sixer and usually will stay the same except for government mandated cost of living raise's.

According to this SS booklet I have here, and the Medicare brother it shares, LOL

Anybody get more then $1,060 a month at 62?

Yep..Based on what most are saying about break even working the math backwards I'd say people are starting out at 62 around $1950-$2200

Posted By: Law Dog

Re: Social Security Benefits - 05/14/18 03:15 AM

Must be either the income bracket or the age bracket then I looked and the max was way more the ever showed up on my SS estimate statements.

That last 35-40 quarters was stopped a few years ago I was told because businesses/farmers were claiming a loss for years then a big profit before they retired so they got the larger SS payments.

Posted By: GritGuy

Re: Social Security Benefits - 05/14/18 03:43 AM

Law, I don't recall the numbers they were receiving only that one was higher than the other, but it probably was not a lot as they took their SS many years ago when incomes were much lower.

As to the 35 quarter rule, don't know where your getting the info that this rule was stopped as in my last notice it states that I have qualified by making the 35 quarters at least.

In the new SS booklet it still states you have to work 35 quarters to qualify for full SS benefits as well.

Farmers and business know loop holes, however it all adds up to the same figure if the big year out weighs the small years as long as they made enough in the small year to use it, other wise if it was a zero in that year they essentially would have to make up the quarter or have an extremely large or better yearly income to make up the difference for that zero year, but they still need the 35 quarters for a full qualification. If they don't then them zero years act against them in the math for SS income amounts

They make more due to their yearly income through 25 quarters but it would not be a full amount due to not having 35 qualifying quarters.

Hope that makes sense !

Posted By: bblwi

Re: Social Security Benefits - 05/14/18 04:07 AM

Farmers also had an option to complete a SSN minimum even if they were losing money. I had several do that during the lean years as it was important to maintain or increase their quarters. I also worked hard to have the many small farmers I worked with (especially those with younger children) to have a positive 1040 F not so much for the income but the benefits for their children if they were disabled or died etc. Many times we paid the spouse a wage so that SSN could be paid in and many times in smaller farms the spouse drew more SSN than the farmer as profits were typically low. We always have to remember that built into the SSN system are income bend points and it is really important to establish income mostly at those lower levels as that is factored in much more than higher incomes are.

Bryce

Posted By: Gary Benson

Re: Social Security Benefits - 05/14/18 11:35 AM

Yep..Based on what most are saying about break even working the math backwards I'd say people are starting out at 62 around $1950-$2200

That's pretty close.

I'm 61 and was taken out of the working game by a Dr., lawyers, and my employer. Considered to be unsafe working around others because of seizure medicaton. I still work, just can't work for money so I work for free. My last 20 yrs I worked 10.5 hrs per day and made good money so also paid in a lot of taxes. I paid SS taxes for 45 years. They told me when I turn 65 the amount won't get sny smaller.

Even when retired, a person still has to do something to get tired so you can sleep at night. I do anyway. Can't stand to do nothing.

I see Natives here that are 30 yrs old and can barely walk, as they've spent their entire lives sitting on their bums doing nothing because they've never had to do a thing for their money.

Posted By: rpmartin

Re: Social Security Benefits - 05/14/18 12:32 PM

I semi retired last year at 55, used the 55 rule to access my 401k penalty free and can still work some to earn a little fun money. This thread is a very interesting read for when its time for me to sign up.

Posted By: Law Dog

Re: Social Security Benefits - 05/14/18 01:42 PM

My past statements read something like if I retired at 62 I would get $1,135 at 65 $1,400 and if disabled at any age the same $1,400 amount per month, but I did get a $25 raise last year.

That along with my State retirement does not make me rich by any means but in paying off my outstanding bills and putting in that wood boiler life is good.

Posted By: Mike C

Re: Social Security Benefits - 05/14/18 02:04 PM

My two cents. Everyone needs to look at their numbers (along with their health and income needs) and decide what is best for them and their family. You also need to look at your break even point for your individual situation. A lot of factors determine your benefits, especially if you are replacing low early worklife income with recent, significantly higher, income for example. Difference between 62 and 66 will have a break even point of mid to late 70s for most folks. Each year you continue to work affects your break even point too as you increase your benefits for each additional year you delay retiring. (That is one reason why Hal will only need 7-8 years to break even)

In general, if you are in good health, making more than $15-20,000 a year, plan to keep working, you would benefit by waiting to draw SS.

Poor health, minimal income, need additional income, you would probably want to start drawing early regardless of if you continue to work.

Posted By: eric space

Re: Social Security Benefits - 05/14/18 02:28 PM

I turn 66 August 1 and will draw then, if I can get their darn website to work. I waited cause I expect to live long enough to make up the difference between drawing at 62 and 66. My father and mother are both still alive (he is 89, she 85) and all their siblings are still alive (all are in their 90's. My 2 grandmothers lived to mid-90's, Grandfather Ralph Space died at 84, my mothers father died at 70 but he was a welder who welded inside depth charges in WWII and it destroyed his lungs. I lead a somewhat clean life, never smoked, very little alcohol,ALWAYS make sure the husband is home if I get called to do ADC work at a house (especially a bat in the house in the middle of the night), and NEVER walk on ice unless I know for a fact that the water underneath is less than 2 feet deep with a gravel bottom.

Most importantly I married a city girl. What does marrying a city girl have to do with long life you ask? I have gotten a good nights sleep for 41 years knowing that a stray click heard during the night is not the sound of a safety clicking off, or a hammer being drawn back and a cylinder rotating forward. Country girls know how to shoot, city girls do not and I sure am not going to show her how!

Posted By: newtoga

Re: Social Security Benefits - 05/14/18 02:48 PM

I retired at 55 with a good pension and took SS at 62. Both together are what I was making while I was working. Iím allowed to make 17300 per year until 66 then unlimited. I have not used any 401k and donít have to till 70 1/2.

I think retiring is upto the individual, go when you want to. Life ainít all about the money.

Posted By: Chamacat

Re: Social Security Benefits - 05/14/18 02:51 PM

I retired at 55 with a good pension and took SS at 62. Both together are what I was making while I was working. Iím allowed to make 17300 per year until 66 then unlimited. I have not used any 401k and donít have to till 70 1/2.

I think retiring is upto the individual, go when you want to. Life ainít all about the money.

Yep..About the 401K..Is that by your choice or some kind of circumstance beyond your choice?..If I may ask

Posted By: Pete in Frbks

Re: Social Security Benefits - 05/14/18 03:10 PM

I turn 66 August 1 and will draw then, if I can get their darn website to work. I waited cause I expect to live long enough to make up the difference between drawing at 62 and 66. My father and mother are both still alive (he is 89, she 85) and all their siblings are still alive (all are in their 90's. My 2 grandmothers lived to mid-90's, Grandfather Ralph Space died at 84, my mothers father died at 70 but he was a welder who welded inside depth charges in WWII and it destroyed his lungs. I lead a somewhat clean life, never smoked, very little alcohol,ALWAYS make sure the husband is home if I get called to do ADC work at a house (especially a bat in the house in the middle of the night), and NEVER walk on ice unless I know for a fact that the water underneath is less than 2 feet deep with a gravel bottom.

Most importantly I married a city girl. What does marrying a city girl have to do with long life you ask? I have gotten a good nights sleep for 41 years knowing that a stray click heard during the night is not the sound of a safety clicking off, or a hammer being drawn back and a cylinder rotating forward. Country girls know how to shoot, city girls do not and I sure am not going to show her how!

Best post so far! Good advice!

Posted By: bblwi

Re: Social Security Benefits - 05/14/18 04:21 PM

I find it interesting to read all the detailed post regarding SSN and how to best utilize when many on here constantly bash the program, call it a commie program, liberal plot and vote for candidates who want to eliminate the program.

Bryce

Posted By: TONY.F

Re: Social Security Benefits - 05/14/18 04:48 PM

IVE BEEN ON SSI disability for four years now and I can tell you that's is the biggest organized crime syndicate on the planet! They pay someone to police your every move! When they are the ones needing policed. What gets me is they act like its their money! I guess I never worked and paid in? even when I was self employed the government got a rather large check every year! If I could keep the medicare they could stick the money were the sun don't shine! id fend for my self! I'd like to go back to work doc says no! but it almost a vendetta now with ssi They tell you you can make x amount of money monthly lol ya and then they take that and then some out of your benfits then give you the boot! I can say after all this I can understand why anyone would want to hose the government! but they give you 2% PAY INCREASE and think you are rich! 2% of nothing is still nothing! Crap I loose more than that digging for my keys in a year!

Posted By: OhioBoy

Re: Social Security Benefits - 05/14/18 05:22 PM

https://www.ssa.gov/pubs/EN-05-10070.pdfThis is the worksheet to figure out what your SS would be. Its dated Jan 2018 and uses the 35 years of your highest earnings.

Step 7 shows that if your are retiring before your full retirement age you get 73.33% of what you would get at full retirement age.

Everyone's case is different and you should have a financial planner look over your details before applying.

Posted By: Gary Benson

Re: Social Security Benefits - 05/14/18 05:31 PM

I find it interesting to read all the detailed post regarding SSN and how to best utilize when many on here constantly bash the program, call it a commie program, liberal plot and vote for candidates who want to eliminate the program.

Bryce

This discussion is from people who have worked and paid in all their lives, not your lazy bum illegals you sneak across the borders.

Posted By: hippie

Re: Social Security Benefits - 05/14/18 05:39 PM

It's official as of this morning! The wife is retired and will get her first check in Aug.

Final numbers as calculated by the lady at the SS office said her break-even, if she waited would be when she is 81yrs and 4 months old.

Posted By: Chamacat

Re: Social Security Benefits - 05/14/18 05:44 PM

Yep..This thread has been very educating to me..There is NOT two people here with the same plan. I certainly appreciate and have read every single post. I have gained so much more knowledge of the road ahead of me in a very short amount of time. What started out at a camp in the high mountains as a casual discussion without to much thought had somehow motivated a curiosity in me. I can go to a financial consultant sure. What I can't get from him is the real life experience each and every one of you has. In fact a consultant would just be one more opinion.

Posted By: star flakes

Re: Social Security Benefits - 05/14/18 05:52 PM

It seems all the working people here who paid all their lives actually are the ones who earned money to put into Social Security for a "living retirement". I was speaking with a retired lady a few months back and she told me that as long as her husband was alive, they had enough to live on, but when he died, she had to move in with her daughter.

That is the Catch 22 of Social Security in numbers of people actually worked their butts off all their lives, but did not have enough to live on, and had withdrawn the minimum, so all they get is minimum back. God bless the people who can calculate their rewards for the best retirement, but for numbers of elderly people, my Mom included, if I did not help her out, she would have been forced into low income housing.

I live in a rural area and I do not know anyone who has money to spare from social security. We checked into food stamps even and even under the 14,000 minimum, she was offered 18 dollars a month. I do not know how foreigners or minorities get the hundreds of dollars in SNAP, because with zero assets, she still did not qualify.

And when I was really sick, the SS told me to spend the few thousand I had in savings as I was "too rich" and then they would look at putting me on disability. I refused.

For those individuals who got the breaks and are inside the system, it works for them. For those who have struggled all their lives, the system has not any benefits, including a friend in Ohio who had MG and was given 12 dollars a month for her disability, so she was working in a drug store to make ends meet.

The fact is all government programs work for two groups, the foreigners and those who have had very good incomes to put into the programs all their lives. For numbers of farmers before the Monsanto era, they went broke 8 out of 10 years, so paid no income taxes or social security. For others like my cousin who worked in the government, he has retired on 55,000 a year and life is a breeze. If you are in the system it works, it you are out of the system, it means you either die or move in with the kids.

Posted By: OhioBoy

Re: Social Security Benefits - 05/14/18 05:56 PM

The social security person wont be taking into account of all your finances. Just be looking at the soc sec end of things.

Taxes. i.e. your soc security, plus the 401k you pulled out that year, plus your spouses income.

i.e. if I can live off of my 401k without soc sec and be comfortable and by waiting get a larger soc sec check which may or may not benefit me personally but may increase what my wife would get after I pass.

Posted By: OhioBoy

Re: Social Security Benefits - 05/14/18 06:01 PM

https://www.usatoday.com/story/money/per...arly/110926124/1. You're still working and will end up forfeiting your benefits anyway

The most obvious situation when it doesn't make sense to claim Social Security early is if you're still working and making enough money that you'll have to forfeit whatever you receive in benefits. The Social Security Administration (SSA) has rules that force you to give up what you get from Social Security if your income is above certain limits.

Specifically, if you make more than $17,040 in 2018 and won't reach your full retirement age during the year, you'll have to give up $1 in annual benefits for every $2 you make above that $17,040 threshold. For someone who'd be slated to get a roughly average monthly check of $1,400 from Social Security, earnings of more than $50,600 would completely wipe out your benefits.

This isn't as bad as it sounds, because in exchange for forfeiting benefits, the SSA treats you as if you had actually waited to claim benefits later. So if you lost a whole year's worth of benefits, you'd effectively get the same benefit amount later that you would have gotten if you'd waited an extra year before claiming. If you know you're going to be working, it's simpler to put off claiming, even if you're old enough to get early benefits.

2. You want to leave your family the most benefits possible

Many people decide when to claim Social Security based solely on their own expectations. Yet in many cases, it's not just your benefits that will suffer a big reduction if you claim early.

Survivor benefits for spouses and eligible children are determined, in part, by when you claim your primary retirement benefits. If you claim early, then the lower monthly payments you get will also be reflected in what your family receives in monthly survivor benefits after you pass away.

Whether those survivor benefits are important depends on your family situation. For spouses who have worked and will have their own retirement benefits, survivor benefits aren't necessarily an important consideration. But for single-earner families, or for those who have disabled children who will be eligible to receive benefits throughout their lives, waiting to claim can have a huge positive influence on their financial futures.

3. Your tax situation might be better if you wait

Many people don't realize that Social Security benefits can be taxable. To find out, take half the benefits you get and add them to any other income that you have. If the total is more than $25,000 for singles or $32,000 for joint filers, then a portion of your Social Security can be subject to income tax.

In some cases, claiming early makes it more likely that your benefits will be taxable. The most common situation is for married couples who file jointly, where one spouse is still working. Even if it's your spouse and not you who brings in taxable income, your spouse's earnings still count toward that threshold.

Social Security can be taxable at any age, so waiting doesn't necessarily get you off the hook. But if you wait, your financial situation might change enough to help you avoid tax.

Posted By: Trapper7

Re: Social Security Benefits - 05/14/18 06:28 PM

I went to the SS office when I turned 65. They advised me that if I waited until 67, I could collect full retirement benefits and earn whatever income I want without penalty of any kind. Income-wise 67 would provide me with the best overall outcome. So, that's what I did. I still work and probably will until I die or my health fails.

Right now health-wise, I feel like the guy who fell out of a 40 story building. As he was falling, he kept saying, "So far so good, so far so good, so far so good........"

Posted By: Chamacat

Re: Social Security Benefits - 05/14/18 06:39 PM

Yep..Sure enough there is language about taking some amount of money out of your 401K's at 70.5 years of age or have a heavy tax imposed.

Another little something I didn't have a clue about.

Posted By: Law Dog

Re: Social Security Benefits - 05/14/18 07:12 PM

I find it interesting to read all the detailed post regarding SSN and how to best utilize when many on here constantly bash the program, call it a commie program, liberal plot and vote for candidates who want to eliminate the program.

Bryce

If anything the should be raising the contributions to keep it going but nobody want's to touch that, look how little we pay in today for what we get back at the end! Not sure how it can be seen as a bad deal with the SS and Medicare a guy gets later in life. Same complainers most likely complain about but no real plan to replace it.

Better to have something then nothing at all but would the ones complaining save enough or expect the Government to take care of them for their bad planning in the end?

Posted By: Trapper7

Re: Social Security Benefits - 05/14/18 07:50 PM

I find it interesting to read all the detailed post regarding SSN and how to best utilize when many on here constantly bash the program, call it a commie program, liberal plot and vote for candidates who want to eliminate the program.

Bryce

If anything the should be raising the contributions to keep it going but nobody want's to touch that, look how little we pay in today for what we get back at the end! Not sure how it can be seen as a bad deal with the SS and Medicare a guy gets later in life. Same complainers most likely complain about but no real plan to replace it.

Better to have something then nothing at all but would the ones complaining save enough or expect the Government to take care of them for their bad planning in the end?

The complaint I have with SS is all the extra addendums lawmakers have tacked onto SS over the years. Originally, it was basically designed to accomplish two things, if you were disabled or died before retirement or if you lived to retirement, you would be compensated for either.

I know of people who never paid a dime into SS, but are collecting full disability for the rest of their lives. Another whose son's college was pretty much paid for because the father was disabled and on SS. They make it too easy to qualify for SS disability in many cases. Once they qualify for SS disability, they're on for life. Who would want to get off when the free money is so easy? SS should be more like Workers Comp where some claimants could be rehabilitated and return to work either full time or part time.

Posted By: jarentz

Re: Social Security Benefits - 05/14/18 09:33 PM

Correct me if i'm wrong.I was told that you pay into ss until you make 125000.per year.After that you don't have to pay ss for that year.

Posted By: jbyrd63

Re: Social Security Benefits - 05/14/18 09:44 PM

My accountant told me I'd need to live to 85 to make up the difference from taking the earliest retirement.

Yes do it as fast as you can. IT or YOU may not be here when you turn 66

Posted By: jbyrd63

Re: Social Security Benefits - 05/14/18 09:46 PM

Originally Posted By: Law Dog

Originally Posted By: bblwi

I find it interesting to read all the detailed post regarding SSN and how to best utilize when many on here constantly bash the program, call it a commie program, liberal plot and vote for candidates who want to eliminate the program.

Bryce

If anything the should be raising the contributions to keep it going but nobody want's to touch that, look how little we pay in today for what we get back at the end! Not sure how it can be seen as a bad deal with the SS and Medicare a guy gets later in life. Same complainers most likely complain about but no real plan to replace it.

Better to have something then nothing at all but would the ones complaining save enough or expect the Government to take care of them for their bad planning in the end?

The complaint I have with SS is all the extra addendums lawmakers have tacked onto SS over the years. Originally, it was basically designed to accomplish two things, if you were disabled or died before retirement or if you lived to retirement, you would be compensated for either.

I know of people who never paid a dime into SS, but are collecting full disability for the rest of their lives. Another whose son's college was pretty much paid for because the father was disabled and on SS. They make it too easy to qualify for SS disability in many cases. Once they qualify for SS disability, they're on for life. Who would want to get off when the free money is so easy? SS should be more like Workers Comp where some claimants could be rehabilitated and return to work either full time or part time.

_________________________

Scouts: Teenage boys and girls camping in the woods together. What could possibly go wrong????

WELLLL you are partly right. BUT most of the people that are drawing that hasn't paid anything in are getting SSI. It is separate but the same if that makes sense.

Posted By: Steven 49er

Re: Social Security Benefits - 05/14/18 09:47 PM

Correct me if i'm wrong.I was told that you pay into ss until you make 125000.per year.After that you don't have to pay ss for that year.

For 2018 it's $128,400

Posted By: MB750

Re: Social Security Benefits - 05/14/18 10:07 PM

I started drawing mine at 62. I get 75% of what I would have received had I waited to draw at 66. No regrets here.

Posted By: Pasadena

Re: Social Security Benefits - 05/14/18 10:12 PM

Life ainít all about the money.

Can I have yours then Doug, then Iíll just burn mine. Lol

Posted By: Dirt

Re: Social Security Benefits - 05/14/18 11:22 PM

Bryce if Social Security is such a great program why mandate it? Let people enroll of their own free will. What is the word I'm thinking of? Oh yeah!" Liberty."

Posted By: snowy

Re: Social Security Benefits - 05/14/18 11:33 PM

I retired at 55 with a good pension and took SS at 62. Both together are what I was making while I was working. I’m allowed to make 17300 per year until 66 then unlimited. I have not used any 401k and don’t have to till 70 1/2.

I think retiring is upto the individual, go when you want to. Life ain’t all about the money.

Yep..About the 401K..Is that by your choice or some kind of circumstance beyond your choice?..If I may ask

Chamacat >>>> to answer your question on the 401K and age 701/2. At that age the Federal Gov. makes you take out so much each year so you have to pay taxes on all that tax deferred money. It is called Required Minimum Distribution.

Posted By: NonPCfed

Re: Social Security Benefits - 05/14/18 11:33 PM

Yep..Sure enough there is language about taking some amount of money out of your 401K's at 70.5 years of age or have a heavy tax imposed.

Another little something I didn't have a clue about.

Remember, 401k is taken out pre-tax so in U.S. Treasury gov speak, they never got a chance to tax any of it so they imposed a minimum age where you have to take some out (and I believe there is a minimum small percentage of what has to come out a year). But then again, all the earnings you had on the 401k before you start withdrawing has been tax-deferred so it seems like a ok trade to me...

Posted By: bblwi

Re: Social Security Benefits - 05/14/18 11:57 PM

Tax deferred 401 Ks etc. have RMD's based on age and life expectancy. The lowest rates come at 70.5 and the annual rate increases each year and peaks near your later 80s or about the time the average American dies. You can have your financial planning person get the chart for you or you can Google it as well I would think. I am going to over withdraw for several years and re-characterize some of the funds.

Bryce

Posted By: v2k

Re: Social Security Benefits - 05/15/18 01:00 AM

For all of you that are drawing early what are you doing about insurance?

Posted By: ebsurveyor

Re: Social Security Benefits - 05/15/18 01:10 AM

I find it interesting to read all the detailed post regarding SSN and how to best utilize when many on here constantly bash the program, call it a commie program, liberal plot and vote for candidates who want to eliminate the program.

Bryce

If anything the should be raising the contributions to keep it going but nobody want's to touch that, look how little we pay in today for what we get back at the end! Not sure how it can be seen as a bad deal with the SS and Medicare a guy gets later in life. Same complainers most likely complain about but no real plan to replace it.

Better to have something then nothing at all but would the ones complaining save enough or expect the Government to take care of them for their bad planning in the end?

I need to comment on "how little we pay in today for what we get back".

I started paying in in 1965 and my employer and I (still working) pay in about $1280 per month. My monthly benefit is currently $2515 but they are stealing $1280 per month from me and my employer. My monthly gain is about $1235. Now look at my earning statement from SSA:

Estimated Total Taxes Paid For Social Security

Paid by you: $142,281

Paid by your employers: $137,322 my account total is $279,603

It will take me almost 19 years just to get back what was put into my account. I started collecting at age 66 so if I can collect until age 84 I'll get back what was put into my account. If my account would have earned 3% or 4% interest my payback age would be 95+.

Social Security is the biggest PONZI SCHEME ever! I'll never get back what was paid into my account. The government uses the money to buy votes from people that don't pay into the system. That is why they are going broke.

Concerning health insurance. I retired from State Employment at age 52 with life time health insurance at no cost to me. Guess what happens at age 65 federal law requires everyone to go on Medicare and Medicare charges me $187.50 per month for the "free Medicare benefit". Again they take from the workers and give to the non-workers.

Posted By: ebsurveyor

Re: Social Security Benefits - 05/15/18 01:54 AM

For all of you that are drawing early what are you doing about insurance?

Lots of them have a wife that works and provides for them.

Posted By: Dirt

Re: Social Security Benefits - 05/15/18 02:17 AM

ebsurveyor, that supposed break even point doesn't include the time value of your money. Don't even go there.

Posted By: Sullivan K

Re: Social Security Benefits - 05/15/18 10:07 AM

For all of you that are drawing early what are you doing about insurance?

I used Cobra for the first 18 months, after I quit working, to the tune of about $568.oo a month. When that ran out I was on Obama care until I turned 65. Obama care cost me about $330.oo a month, but I think I got about $400.oo a month in subsidies, so the real cost of Obama care was close to $730.oo a month. Now I am on Medicare. I'd have to look but I think Medicare costs me a little less than $300.oo a month, including my secondary insurance and prescription insurance.

Posted By: coolstucco

Re: Social Security Benefits - 05/15/18 11:33 AM

"I know of people who never paid a dime into SS, but are collecting full disability for the rest of their lives. Another whose son's college was pretty much paid for because the father was disabled and on SS. They make it too easy to qualify for SS disability in many cases. Once they qualify for SS disability, they're on for life. Who would want to get off when the free money is so easy? SS should be more like Workers Comp where some claimants could be rehabilitated and return to work either full time or part time." Quoted from Trapper7

I for one can't wait to get off of SS disability. I am very thankful for the money right now, but it is not enough to raise a family on and I would much rather feel good and be able to work full time then get the small amount of disability check. As Tony F stated they give you a 2% increase in your monthly check but they take twice that amount away as an increase on Medicare.

Posted By: 2ndjoborfun

Re: Social Security Benefits - 05/15/18 01:01 PM

y2k - My question also.

Posted By: 2ndjoborfun

Re: Social Security Benefits - 05/15/18 01:01 PM

Health insurance that is.

Posted By: Dirt

Re: Social Security Benefits - 05/15/18 03:29 PM

I find it interesting to read all the detailed post regarding SSN and how to best utilize when many on here constantly bash the program, call it a commie program, liberal plot and vote for candidates who want to eliminate the program.

Bryce

I don't see it this way. What I see is people who have been having money stole from them their entire lives, finagling the best way to steal it back.

Posted By: hippie

Re: Social Security Benefits - 05/15/18 03:31 PM

I find it interesting to read all the detailed post regarding SSN and how to best utilize when many on here constantly bash the program, call it a commie program, liberal plot and vote for candidates who want to eliminate the program.

Bryce

I don't see it this way. What I see is people who have been having money stole from them their entire lives, finagling the best way to steal it back.

Bingo

Posted By: hippie

Re: Social Security Benefits - 05/15/18 03:32 PM

We are doing without, paying our way.

Posted By: ebsurveyor

Re: Social Security Benefits - 05/15/18 04:18 PM

ebsurveyor, that supposed break even point doesn't include the time value of your money. Don't even go there.

Mr. Dirt, you at least understand. For workers SS is a ponzi scheme. For others it is the mythical "free lunch".

Posted By: Dirt

Re: Social Security Benefits - 05/15/18 05:15 PM

Maybe we can esplain it. The government takes $100 out of your paycheck in 1965. The government gives you back $100 in 2018. That $100 in 1965 would have bought 57 six packs of PBR. In 2018 that $100 will only buy you 18 six packs of Pabst. Depending on your drinking ability the government robbed you of about 20 good drunks.

Posted By: Gary Benson

Re: Social Security Benefits - 05/15/18 05:26 PM

Maybe we can esplain it. The government takes $100 out of you paycheck in 1965. The government gives you back $100 in 2018. That $100 in 1965 would have bought 57 six packs of PBR. In 2018 that $100 will only buy you 18 six packs of Pabst. Depending on your drinking ability the government robbed you of about 20 good drunks.

Just think what that money would have done if the Gubmint had saved that for us in a 401K plan. After all, the Gubmint knows best how to manage our money.

Posted By: 1lessdog

Re: Social Security Benefits - 05/15/18 05:56 PM

For me I will start at 66 and 8 months. I will get Medicare and Medicaid. So I have to work to get insurance from my employer. I say right now I work for insurance for my Wife and we still have 3 under the age of 26, so we have them insured to.

Posted By: Dirt

Re: Social Security Benefits - 05/15/18 06:20 PM

Maybe we can esplain it. The government takes $100 out of you paycheck in 1965. The government gives you back $100 in 2018. That $100 in 1965 would have bought 57 six packs of PBR. In 2018 that $100 will only buy you 18 six packs of Pabst. Depending on your drinking ability the government robbed you of about 20 good drunks.

Just think what that money would have done if the Gubmint had saved that for us in a 401K plan. After all, the Gubmint knows best how to manage our money.

All long term employed people would have been money ahead if they would have taken

their money and put it into an ordinary savings account pre 2008. The money would be theirs and if they die

at any age the money would go to their beneficiaries.

Posted By: kenny k

Re: Social Security Benefits - 05/15/18 11:12 PM

You all make a good point. I will retire nov at 62. I thought i would go one more year, but for only another 53.00 not for me!

Posted By: Hal

Re: Social Security Benefits - 05/16/18 03:39 PM

Yep..for numbers sake..If a guy retires at 62 and gets 1700.00 a month (early retirement). He takes that amount each month for 52 months (which makes his age 66.4 years old) he will be $88,400 dollars ahead in 4 years 4 months.

So if he waits till 66.4 years for his first check and it's $2300.00 how many years will it take to make up the $88,400 dollars?

If That same guy waited until he was at age 70 and gave up 96 months at $1700. he would have left $163,200 dollars on the table..thus making this cat an old old cogger making up that kind of cash

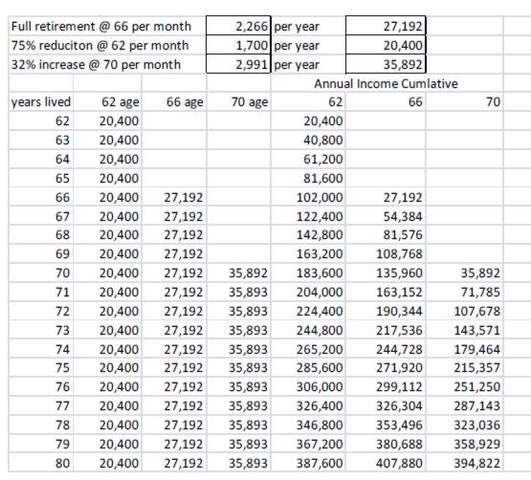

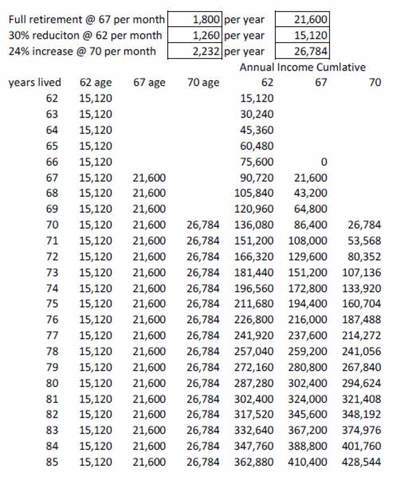

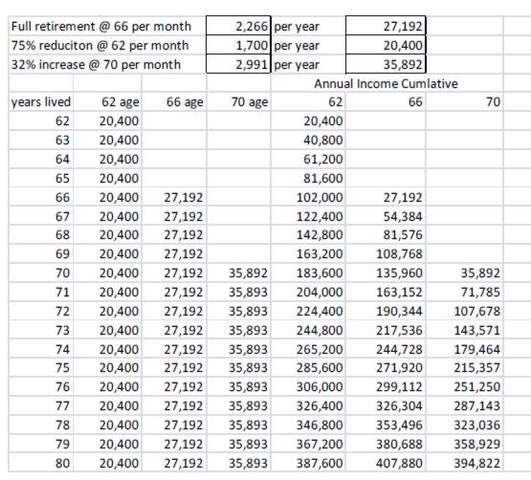

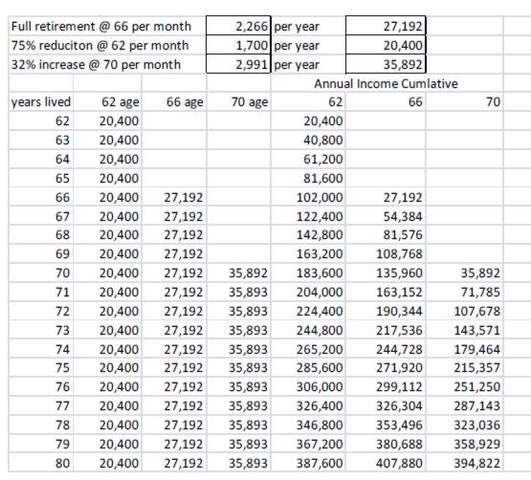

Here you go: (Based on age 66)

If this individual waits until 66 he breaks dead even at age 77

If he waits until 70 it looks like it will take until 81 to break even.

Posted By: Trapper7

Re: Social Security Benefits - 05/16/18 03:57 PM

There is no doubt if you were to put the same amount of money in a bank, at retirement age, considering interest on that money, you would have a larger lump sum than SS provides. But, most people can't systematically put away the savings on a long term basis. So, the government forces you to do it. For most people it's a good thing, even if from an investment standpoint it's not.

Posted By: hippie

Re: Social Security Benefits - 05/16/18 04:02 PM

Yep..for numbers sake..If a guy retires at 62 and gets 1700.00 a month (early retirement). He takes that amount each month for 52 months (which makes his age 66.4 years old) he will be $88,400 dollars ahead in 4 years 4 months.

So if he waits till 66.4 years for his first check and it's $2300.00 how many years will it take to make up the $88,400 dollars?

If That same guy waited until he was at age 70 and gave up 96 months at $1700. he would have left $163,200 dollars on the table..thus making this cat an old old cogger making up that kind of cash

Here you go: (Based on age 66)

If this individual waits until 66 he breaks dead even at age 77

If he waits until 70 it looks like it will take until 81 to break even.

Good post Hal.

We have to wait until we're 67 which adds another 3 years to the break even part.

That's a very good chart showing it tho.

Posted By: Hal

Re: Social Security Benefits - 05/16/18 04:02 PM

I see all these 85--84 year break even points. I don't understand. My break even point is 77 years 11 months. That's a big difference.

Monthly Social Security benefits

Retirement age

Break-even age

$2,102

62 vs. 66

Between 77 and 78

$2,806

62 vs. 70

Between 80 and 81

$3,721

66 vs. 70

Between 82 and 83

Now this is just a example and these ages go up for break even age from the amount you receive, expenses, returns etc.

(Edit: That should read 25% reduction at age 62.)

The break even between 62 vs 66 is at 77

66 vs 70 is at 82

62 vs 70 is at 80

Posted By: hippie

Re: Social Security Benefits - 05/16/18 04:07 PM

For that guy to draw that much, he had to make some dang good money! He shouldn't need SSI! lol.

The wife made really good money (I thought) and she draws 1600.

Posted By: wy.wolfer

Re: Social Security Benefits - 05/16/18 04:12 PM

Social Security is headed for problems, it's no wonder liberals want to make most gun ownership a felony, then you can't get S.S.

Posted By: Hal

Re: Social Security Benefits - 05/16/18 05:03 PM

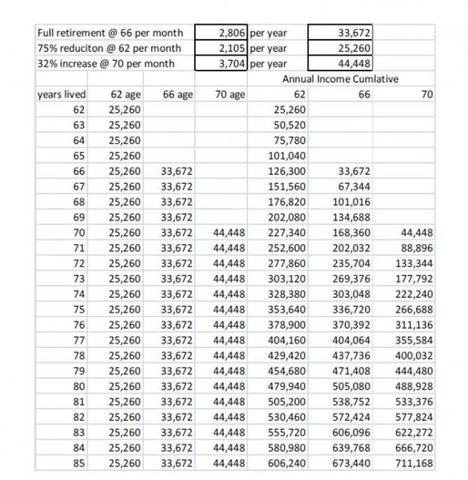

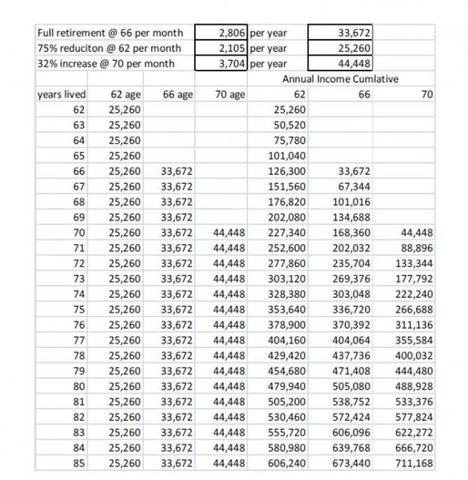

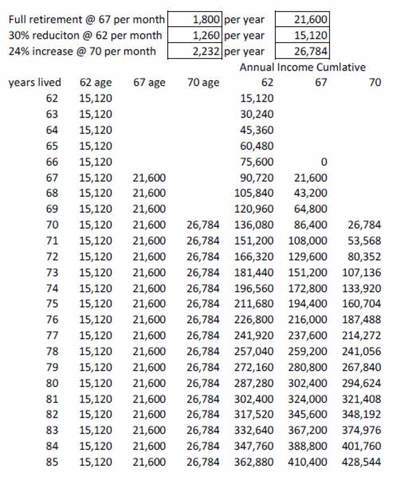

We have to wait until we're 67 which adds another 3 years to the break even part.

That's a very good chart showing it tho.

Here you go, adjusted to age 67

Bear this in mind, if you are retiring at age 67 your early retirement benefits are reduceD by 30%, not 25%

The 8% annual increase between 67-70 stays the same.

By the previous chart.

62 vs 66 evens at 77

66 vs 70 evens at 81

By this chart

62 vs 67 evens at 78

67 vs 70 evens at 82

That's not three years difference. It's about 1 year which is logical in that you would be retiring 1 year later than a person at 66.

Posted By: hippie

Re: Social Security Benefits - 05/16/18 05:08 PM

Yep, that's what we were looking at.

Her break-even was just short of 82. From 62 to 67 she would draw just short of 1000,000 dollars and at 5k a year more (full) if she waited until 67, we'd be too old to enjoy the extra...we figured.

Posted By: Hal

Re: Social Security Benefits - 05/16/18 05:12 PM

Social Security is headed for problems, it's no wonder liberals want to make most gun ownership a felony, then you can't get S.S.

Yeah buddy! That's why the liberals want your guns. (

FOR CRYIN' OUT LOUD!!!)

But there is one problem, (from the SSI website)

Individuals released from incarceration may be eligible for Social Security retirement, survivors, or disability benefits if you have worked or paid into Social Security enough years or Supplemental Security Income benefits if you are 65 or older, or are blind, or have a disability and have little or no income and resources.

Posted By: hippie

Re: Social Security Benefits - 05/16/18 05:21 PM

One thing that happened that i didn't understand,,, but didn't question because it was to our benefit was..........

When we went up months ago and got figures and to set-up an appt, they were lower than what we will actually get once the girl signed us up.

The first time, we were just asking what we'd get and set-up an appt to do the actual applying.

Guess the first gal just rounded things, or there were additional deductions or whatever that gave us more per month once we filled out the papers.

Posted By: Hal

Re: Social Security Benefits - 05/16/18 05:24 PM

Some of these calculations run out to three or four decimal points. They don't cipher that until push comes to shove. That's why they always tell you it's an approximation. Generally you can count on the approximation being close.,

Posted By: ebsurveyor

Re: Social Security Benefits - 05/16/18 06:02 PM

Some of these calculations run out to three or four decimal points. They don't cipher that until push comes to shove. That's why they always tell you it's an approximation. Generally you can count on the approximation being close.,

Hey Hal, you seem to know your SS Stuff. Explain the extra benefit that you get if you are born in October.

Posted By: bblwi

Re: Social Security Benefits - 05/16/18 06:03 PM

With the cost of living ever increasing we will see more and more workers working much longer in life, many into their 70s, mostly because they have not saved enough money to retire on. That to me makes the 62 age more viable. If two workers in a house hold had say 80K of income and were going to receive say 32 K in ssn at 62 and now with the increased income b4 paying back they could earn 35 k per year and not pay back any SSN. That gives them 77K per year w/0 any pension, 401 K or savings. They could work part time for a decade or two if needed and that would allow their 401 Ks to grow as well.

Bryce

Posted By: ratbrain

Re: Social Security Benefits - 05/16/18 06:08 PM

I took early retirement and started drawing SS at 62. Life holds no guarantees.

Posted By: Sliprig

Re: Social Security Benefits - 05/16/18 06:15 PM

Hal or anybody?

What about this? You benefit is based on the highest 35 years of earnings. For most people if you work later in life your salary is higher than in the early years. Anybody put that on paper? (I'm working on mine) One case for not cutting your hours back late in life. If you have that choice.

Slip

Posted By: snowy

Re: Social Security Benefits - 05/16/18 06:25 PM

I heard some experts talk on this subject a few different time. When is the best to take SS. I can tell you they all said it really is a wash when you start. They all said that the Gov. isn't going to give you any more then what you have put in. It is no different then a pension plan get the lump sump or that a monthly option pay out. One always sounds/looks better then the other option but bottom line they aren't going to pay you any more then what you have into the program.

It really come down to each person has different philosophy and needs when to take SS. My plan is to take it as soon as I can that option is good for me in some ways but it may hurt me in other ways going forward.

Posted By: Chamacat

Re: Social Security Benefits - 05/16/18 06:39 PM

I heard some experts talk on this subject a few different time. When is the best to take SS. I can tell you they all said it really is a wash when you start. They all said that the Gov. isn't going to give you any more then what you have put in. It is no different then a pension plan get the lump sump or that a monthly option pay out. One always sounds/looks better then the other option but bottom line they aren't going to pay you any more then what you have into the program.

It really come down to each person has different philosophy and needs when to take SS. My plan is to take it as soon as I can that option is good for me in some ways but it may hurt me in other ways going forward.

Yep..Believe me I'm no expert..LOL

Social Security was signed like in the year 1935..OK..So a guy turns 65 two years after 1935..He has worked let's say 40 years..He has only contributed 2 years in the program..Now that same guy let's say is still alive in the year 1960..I would think that man still get's his monthly check whatever that amount is..and he would have went way over his contribution to the program..