Home

Silver shot up......

Posted By: Marty

Silver shot up...... - 07/22/20 08:04 PM

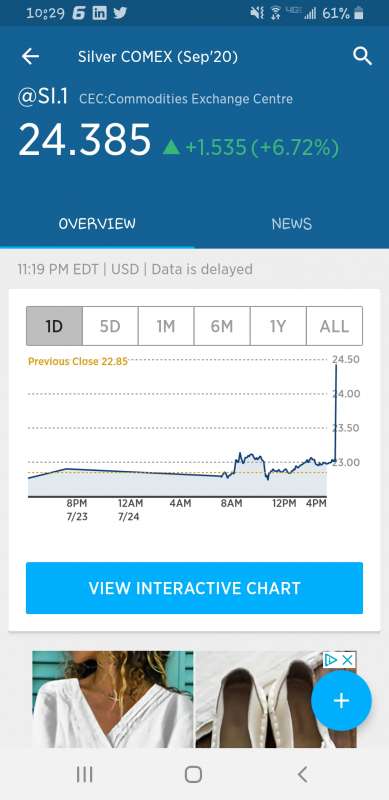

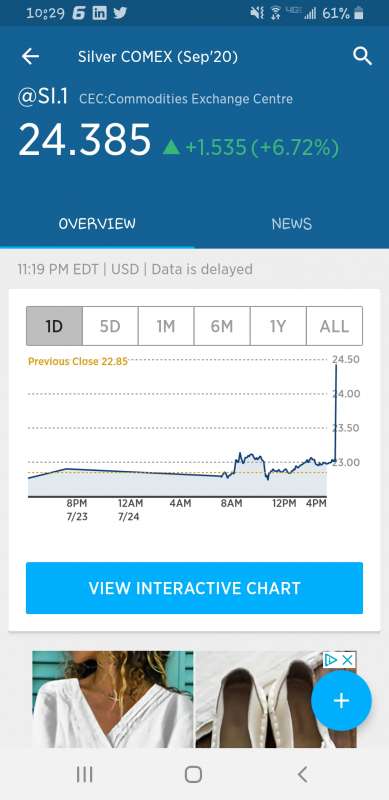

$23.00+ an ounce @ 3pm.

Posted By: yukon254

Re: Silver shot up...... - 07/22/20 08:12 PM

wow my son will be happy. He bought a bunch of it last May.

Posted By: 160user

Re: Silver shot up...... - 07/22/20 08:20 PM

I have all my spare cash tied up in steel and lead.

Posted By: Finster

Re: Silver shot up...... - 07/22/20 08:29 PM

I have all my spare cash tied up in steel and lead.

Nice! I have brass and lead myself.

Posted By: maintenanceguy

Re: Silver shot up...... - 07/22/20 08:55 PM

I have all my spare cash tied up in steel and lead.

Good news. Both are way up right now.

Posted By: Hodagtrapper

Re: Silver shot up...... - 07/22/20 09:10 PM

Copper is on the rise at yearly highs as well. I have 1/2 ton to process and sell soon.

Chris

Posted By: Gary Benson

Re: Silver shot up...... - 07/22/20 10:42 PM

So they say this is because of consumer demand in China? And possibly India? I don't believe that. Gold is way up there also. I figure the professional athletes are buying the gold as bling.

Posted By: Sprung & Rusty

Re: Silver shot up...... - 07/22/20 11:21 PM

Metals are up, interest is down, inflation could be on the horizon.

Posted By: Marty

Re: Silver shot up...... - 07/23/20 12:21 AM

People may be loosing confidence in printed $.

Posted By: Gary Benson

Re: Silver shot up...... - 07/23/20 12:23 AM

I'd feel like an idiot paying $1868 for an ounce of gold. That's just me though.

Posted By: Gary Benson

Re: Silver shot up...... - 07/23/20 12:23 AM

$23 for silver, maybe.

Posted By: WadeRyan

Re: Silver shot up...... - 07/23/20 12:25 AM

I'd feel like an idiot paying $1868 for an ounce of gold. That's just me though.

Gold is a more long term investment. Wouldn't put the farm on it but it's not bad to have around. Silver can make you some quick cash but what if the cash becomes worthless?

Posted By: Marty

Re: Silver shot up...... - 07/23/20 12:37 AM

If cash becomes worthless silver/gold may be a good thing to have for currency.

Posted By: Rat Masterson

Re: Silver shot up...... - 07/23/20 01:02 AM

If cash becomes worthless we will have bigger problems than the price of gold or silver. Guns and ammo will be where it's at.

Posted By: KeithC

Re: Silver shot up...... - 07/23/20 01:04 AM

If cash becomes worthless we will have bigger problems than the price of gold or silver. Guns and ammo will be where it's at.

Yep!

Keith

Posted By: James

Re: Silver shot up...... - 07/23/20 01:08 AM

Imagine how the value of our gun investments will shoot (lol) up if Biden wins!

Jim

Posted By: WadeRyan

Re: Silver shot up...... - 07/23/20 01:09 AM

I don't think a cashless society is really all that far out there. I'm not saying I agree with it or that it's a good thing. I can see it on the horizon.

Posted By: Marty

Re: Silver shot up...... - 07/23/20 01:10 AM

If cash becomes worthless we will have bigger problems than the price of gold or silver. Guns and ammo will be where it's at.

When people realize that cash is worthless there will be some kind of commerce that will not involve guns/ammo although those things will have a high barter value.....silver and gold have been used to pay for goods for an awful long time until printed currency came along.

Posted By: Sprung & Rusty

Re: Silver shot up...... - 07/23/20 01:11 AM

Imagine how the value of our gun investments will shoot (lol) up if Biden wins!

Jim

He and Beto will confiscate them.

James the 2nd

Posted By: Blaine County

Re: Silver shot up...... - 07/23/20 01:12 AM

It's good to own some precious metals for when things finally go totally off the rails. Otherwise, I agree. Steel and lots of lead are more important. And buy as much land as you can and keep buying it.

Posted By: Blaine County

Re: Silver shot up...... - 07/23/20 01:15 AM

Imagine how the value of our gun investments will shoot (lol) up if Biden wins!

Jim

I've thought about that quiet a bit. I know I would never sell them, but high capacity magazines will be the real money maker.

My advice--if you haven't been stocking up on them by now, you are late.

Posted By: yukon254

Re: Silver shot up...... - 07/23/20 01:17 AM

Talked to a guy one time from Bosnia. He said their system went down the tubes and overnight cash money wasn't worth anything. He said as time went on two of the most valuable things were coffee and Bic lighters.

Posted By: Steven 49er

Re: Silver shot up...... - 07/23/20 01:36 AM

Silver is just getting warmed up, gold is 3 percent from it's all time high. It will take some time but silver should make a run at it's high. It has nothing to do with industrial demand or jewelry and everything to do with central banks of the world taking the breaks of the printing press.

Gold is not currency, it's the only true form of money

Posted By: white17

Re: Silver shot up...... - 07/23/20 01:48 AM

The majority of the gain n Ag/AU is because of the the weakness of the dollar, which has declined 2% this month. Inflation isn't even a blip on the horizon.

The ratio of prices between AU & AG hit 124 in March.

Currently that ratio is 83

The 35 year average of that ratio is below 70. That tells ya one of two things will happen. Gold will drop or silver will rise.

Posted By: nate

Re: Silver shot up...... - 07/23/20 02:52 AM

How do you go about buying silver? Do you buy coins? Rings? What else?

Posted By: Rat Masterson

Re: Silver shot up...... - 07/23/20 02:55 AM

White, with the weakening of the dollar fur prices should go up. LOL

Posted By: WadeRyan

Re: Silver shot up...... - 07/23/20 03:00 AM

I'm a bullion guy myself. Buy it in either 1 oz. coins or bars. Sometimes I bought the bars in 5oz, 10 oz, or Kilo's. Just depends how much you want to invest. When I was buying it I used bullion direct which I believe has since when bankrupt. Apmex is the company my father continues to buy from.

Posted By: white17

Re: Silver shot up...... - 07/23/20 03:01 AM

White, with the weakening of the dollar fur prices should go up. LOL

Should I hold my breath ??

Posted By: Northof50

Re: Silver shot up...... - 07/23/20 03:02 AM

Copper and silver for the computer manufacturing is in demand since the shops have started back up and running.

Very little gold is used in the interphase circuits.

Posted By: nate

Re: Silver shot up...... - 07/23/20 03:12 AM

Thanks Wade Ryan

Posted By: white17

Re: Silver shot up...... - 07/23/20 03:17 AM

It may or may not impact you much depending on your tax bracket but precious metals capital gains are not treated like other capital gains. The long term rate is 31.8 max.,..8% higher than other cap/gains. Short term gains are taxed over 40%. Just another of the many disadvantages to buying/trading precious metals.

Posted By: NonPCfed

Re: Silver shot up...... - 07/23/20 03:23 AM

Yeah, the percent Apmex is charging over spot has certainly gone up. In past few years, I've bought U.S. silver eagles of the calendar year for about $7-8 over spot. Just checked, 2020 Eagles are running over $35 a piece on Apmex and spot now is $22. In January or so, I bought a roll of ave circulated Merc dimes from Ampex for I think $76. Now they're $97 but that's still lower than what they were at the end of March. I'm sure the Apmex, and all the precious metals reseller people are smiling...

Posted By: run

Re: Silver shot up...... - 07/23/20 09:46 AM

Silver is just getting warmed up, gold is 3 percent from it's all time high. It will take some time but silver should make a run at it's high. It has nothing to do with industrial demand or jewelry and everything to do with central banks of the world taking the breaks of the printing press.

Gold is not currency, it's the only true form of money

Interesting.

Posted By: Blaine County

Re: Silver shot up...... - 07/23/20 10:51 AM

The majority of the gain n Ag/AU is because of the the weakness of the dollar, which has declined 2% this month. Inflation isn't even a blip on the horizon.

The ratio of prices between AU & AG hit 124 in March.

Currently that ratio is 83

The 35 year average of that ratio is below 70. That tells ya one of two things will happen. Gold will drop or silver will rise.

I think you're right. It seems like silver has some more room to run in the near future.

Posted By: seniortrap

Re: Silver shot up...... - 07/23/20 02:21 PM

If cash becomes worthless silver/gold may be a good thing to have for currency

Posted By: Gary Benson

Re: Silver shot up...... - 07/23/20 02:56 PM

If cash becomes worthless silver/gold may be a good thing to have for currency

Plastic debit card/credit card.

Posted By: larrywaugh

Re: Silver shot up...... - 07/23/20 03:24 PM

Is the price of scrap steel rising also?

Posted By: Marty

Re: Silver shot up...... - 07/23/20 03:25 PM

If cash becomes worthless silver/gold may be a good thing to have for currency

A couple of 90% silver dimes....it would be homemade bread/butter.

Posted By: SNIPERBBB

Re: Silver shot up...... - 07/23/20 03:34 PM

Is the price of scrap steel rising also?

Not sure about those but cryptos are up again

Posted By: BvrRetriever

Re: Silver shot up...... - 07/23/20 03:41 PM

The problem with buying precious metals is the sales tax. You automatically lose that right from the start.

Posted By: star flakes

Re: Silver shot up...... - 07/23/20 03:42 PM

There are two problems with metal. The first problem is that silver and gold are heavy in you can't flee with it and when it comes down to it, the guy with a gun and loaves of bread and toilet paper is going to give you what he says the price is for that shiny metal, just like people are being cheated in this Coronavirus market.

Second is a bit more interesting as in atomic warfare, metals absorb radioactivity. Gold, silver, platinum or anything else gets exposure to a nuclear reaction, and it will be pure poison, just like sticking your head into a nuclear reactor. Lastly, there are cobalt stockpiles and tons of cobalt in your batteries. In a hydrogen detonation, all of that transforms into something more lethal than plutonium, as the half life is 5 years, it will kill every red blooded creature in that area. That is what a cobalt bomb is and why the Russians have been building their "Tidal Wave" bombs using cobalt cores.

This silver jump has nothing to do with market use for computer manufacturing gearing up. No more than gas prices spiking for " summer holidays". It is the 1% phreaking suckers into buying silver as a great investment, to drain liquidity from the few people who have money in this plague, before the price deflates again.

No one is going to get rich from silver and gold. FDR stole all the gold from people by decree. If those in power want that coin they will make you a criminal and take it. People should be caching things they need, so they do not have to barter 500 pounds of silver for a loaf of bread.

Posted By: Marty

Re: Silver shot up...... - 07/23/20 03:51 PM

If there is a nuclear holocaust things could get dicey.....

Posted By: Nessmuck

Re: Silver shot up...... - 07/23/20 04:01 PM

Talked to a guy one time from Bosnia. He said their system went down the tubes and overnight cash money wasn't worth anything. He said as time went on two of the most valuable things were coffee and Bic lighters.

![[Linked Image]](https://trapperman.com/forum/attachments/usergals/2020/07/full-22754-56086-ee8fdd8c_e2cc_4282_87a1_8dc078863099.jpeg)

I can always make fire

Posted By: Larry Hall

Re: Silver shot up...... - 07/23/20 04:03 PM

Lot of ways to gain exposure to the metals.. Awfully high right now to be buying into.. Probably a pull back just ahead of us after this big run up.. I'd really keep an eye on silver and buy with both hands if it drops back to $18.50 is what some smart folks are saying..PSLV through a brokerage account is a very easy way to play.. Miners are another avenue, but you know what Mark Twain said about Gold mines (silver to) They are a hole in the ground with a liar standing over it, loosely parphrased LOL... But a couple of liars I'd watch are AG, FNV and the ETF SILJ..

Posted By: Foxpaw

Re: Silver shot up...... - 07/23/20 06:28 PM

I get a lot of junk mail and its mostly to sell me something I don't need. The latest has been a sell starting out with the goverment buying all the gold in the 1920's at $20.67 per ounce, then when they got most of it bought up they valued it at $32. Made the gov a nice profit. Then in the "70's we went off the gold standard and went to monopoly money. Now what this guy was saying is that with the big covid give away and all the trillions owed to China, the only way they can overcome is to change games and make a profit the way they did with the gold in the depression era He says that the gov will set an expiration date that all cash will expire and if you have any kept back you can keep it with your Confederate Greybacks and wait for it to be a collectors item. In the process everything will be switched to electronic money and a new game.

I had already wasted 15 minutes reading the sales pitch and didn't read the cure or the price he was wanting. So if you think the game is changing then get ready to "Come On Down".

Posted By: white17

Re: Silver shot up...... - 07/23/20 06:36 PM

LOL !!!! What gets me is ....if precious metals are such a great deal, why are these people begging you to buy theirs ??

Posted By: ebsurveyor

Re: Silver shot up...... - 07/23/20 06:41 PM

What goes up must come down.

Posted By: SNIPERBBB

Re: Silver shot up...... - 07/23/20 06:58 PM

LOL !!!! What gets me is ....if precious metals are such a great deal, why are these people begging you to buy theirs ??

They probably make money on both sides of the sales so what the spot price is don't matter much to them and if it crashes they just buy more till the price rebounds.

Posted By: white17

Re: Silver shot up...... - 07/23/20 07:14 PM

Some of the bigger ones are no doubt hedging also even though that could be expensive at these levels

Posted By: Steven 49er

Re: Silver shot up...... - 07/23/20 07:56 PM

The majority of the gain n Ag/AU is because of the the weakness of the dollar, which has declined 2% this month.

That goes without saying. With another 2 trillion dollar stimulus in the works the DXY will go lower, there isn't anything from stopping the dollar dropping to levels during the last recession. With the amount of money being created it should go even lower. That should bode well for the fur market but not this fall. I agree that inflation isn't in the picture, at least not yet, we'll see a deflationary spiral first. Also just wait until the FED starts buying equities. Then it will be katy bar the door.

Yeah, the percent Apmex is charging over spot has certainly gone up. In past few years, I've bought U.S. silver eagles of the calendar year for about $7-8 over spot. Just checked, 2020 Eagles are running over $35 a piece on Apmex and spot now is $22. In January or so, I bought a roll of ave circulated Merc dimes from Ampex for I think $76. Now they're $97 but that's still lower than what they were at the end of March. I'm sure the Apmex, and all the precious metals reseller people are smiling...

Eagles are selling at such a high premium because the mint shut down, it's a supply issue. A person could have purchased a roll of dimes in March for far lower than in March, maybe not apmex but lower non the less. There is approximately 3.55 ounces of silver in a roll of dimes, I was buying five ounce bars for less than 97 end of march early april. Hard to find but they were out there. Establish a relationship with the bullion dealers, jewelers and pawn shops in the sioux falls area.

The problem with buying precious metals is the sales tax. You automatically lose that right from the start.

Not all states charge sales tax on bullion, MN and WI do, I go to ND or do private transactions with like minded individuals.

There are two problems with metal. The first problem is that silver and gold are heavy.

Silver is heavy, a pocket full of gold is not so much. I'm not fleeing anywhere, I like it here.

LOL !!!! What gets me is ....if precious metals are such a great deal, why are these people begging you to buy theirs ??

For the same reason people sell stocks. Ken, what do you think about Shelton probably being on the board of Governors for the Federal Reserve. The Keynesians must be rolling in their graves lol.

Posted By: white17

Re: Silver shot up...... - 07/23/20 08:03 PM

I think she may be a breath of fresh air. God knows they don't have any exit plan for where they are now. Some unorthodox ideas might be a good thing !!

Posted By: Larry Hall

Re: Silver shot up...... - 07/23/20 08:10 PM

White17.. those cats begging you to buy their metal are making bank at both ends.. Considerable spot over market price to purchase physical right now, and then God forbid you ever sell back to them, a deep discount to market.. I'd say it's a great business to be in as long as you don't have a conscience.. My .02 worth anyways..

Posted By: white17

Re: Silver shot up...... - 07/23/20 08:13 PM

I'm sure you're right !!

Posted By: Sprung & Rusty

Re: Silver shot up...... - 07/23/20 08:53 PM

Lot of ways to gain exposure to the metals.. Awfully high right now to be buying into.. Probably a pull back just ahead of us after this big run up.. I'd really keep an eye on silver and buy with both hands if it drops back to $18.50 is what some smart folks are saying..PSLV through a brokerage account is a very easy way to play.. Miners are another avenue, but you know what Mark Twain said about Gold mines (silver to) They are a hole in the ground with a liar standing over it, loosely parphrased LOL... But a couple of liars I'd watch are AG, FNV and the ETF SILJ..

If it drops that low, lots of people will buy. Demand will be high. Wonder if it will be hard to get.

Posted By: snowy

Re: Silver shot up...... - 07/23/20 09:06 PM

Price of precious metals are rising from the new trillions the Gov is planning for covid relief. That was my take on what I have read and have heard on the news.

Posted By: stinkypete

Re: Silver shot up...... - 07/23/20 11:34 PM

We are selling. Will buy again when it tanks. People like to do the opposite. Not sure why. Greed, fever. Who knows. As the old saying goes. Buy low. Sell high.

Posted By: Steven 49er

Re: Silver shot up...... - 07/24/20 12:03 AM

I think she may be a breath of fresh air. God knows they don't have any exit plan for where they are now. Some unorthodox ideas might be a good thing !!

When did believing in the gold standard and sound money practices become unorthodox? Serious question.

White17.. those cats begging you to buy their metal are making bank at both ends.. Considerable spot over market price to purchase physical right now, and then God forbid you ever sell back to them, a deep discount to market.. I'd say it's a great business to be in as long as you don't have a conscience.. My .02 worth anyways..

If that is what you call not having a conscience, what do you call it when Apple pays way hung lo chinaman slave wages to produce an item and sell it over here for a mark up that makes the bullion dealers envious.

There is a large market out there for metals outside of the big dealers, buy and sell in the street, beat the bush.

Posted By: NonPCfed

Re: Silver shot up...... - 07/24/20 12:13 AM

Steven49er- Buying silver is not one of my hobbies, usually do it only once a year. The junk Merc dimes this winter were a first for me. I'd love to see some pics of your silver stash but then you'd have to whack us so I think I'll pass

But, if I was going to get into silver in a bigger way, I'd would follow your advice to network...

Posted By: ebsurveyor

Re: Silver shot up...... - 07/24/20 12:35 AM

*

Posted By: Steven 49er

Re: Silver shot up...... - 07/24/20 12:43 AM

My silver stack isn't very big. I lost most of it in a suspicious boating accident. Sad part is my AR lowers and high capacity magazines went down with it as well.

Seriously though, it's not all that big, no where near as big as I'd like. I'll slowly add to the pile, roll of dimes here, a roll of quarters there eventually it adds up. No time better than the present to network, who knows, maybe you could develop a side hustle buying and selling. I'd love to do it but there just isn't enough people up here, if I lived near one of the coasts I'd be all over it.

Posted By: Larry Hall

Re: Silver shot up...... - 07/24/20 01:55 AM

Steven49er. Kind of the same thing isn’t it? I’ve seen a couple of acquaintances really get taken to the wood shed. Their own fault, but I sure don’t care for the way they do business. My opinion. I’m not a big metals guy. Bought some physical years ago and Have added to it when deals pop up. Kinda like buying guns.

Posted By: white17

Re: Silver shot up...... - 07/24/20 02:04 AM

I think she may be a breath of fresh air. God knows they don't have any exit plan for where they are now. Some unorthodox ideas might be a good thing !!

When did believing in the gold standard and sound money practices become unorthodox? Serious question.

I hear ya. I can't recall which Dem it was who called her views on the gold standard "controversial".

Posted By: Steven 49er

Re: Silver shot up...... - 07/24/20 05:53 AM

The Democrats or the Republicans will never willing go for a gold standard. Can't have deficit spending with it. Not to the degree we see today. Personally I'd rather see Danielle DeMartion Booth on the board but I'll take Shelton. It's a hoot to see the Keynesian's throw a fit. They credit the FED for saving the economy after the collapse in 2008, all it did was create a bigger bubble. Eventually it's going to pop.

Larry Hall, I'm kinda like you buying metals, buy whenever I feel like i have some discretionary income to spend and buy in tranches on the dips. I felt that silver under 20 was a good buy and when we could get it under 15 was a really good buy. I tried to buy a big chunk in April but demand outstripped supply and I don't like paying outrageous premiums. I only ended up with a small bit.

Posted By: walleyed

Re: Silver shot up...... - 07/24/20 11:29 AM

How is BITCOIN doing ?

Are you mega-rich yet ?

w

Posted By: Steven 49er

Re: Silver shot up...... - 07/24/20 11:36 AM

It's doing good, how are your investments doing?

Posted By: walleyed

Re: Silver shot up...... - 07/24/20 11:42 AM

It's doing good, how are your investments doing?

Good.

I've gained back about 75% of what I lost

when the stock market dropped from it's

highs in January due to the Covid-19 thingy.

Just waiting for November 9th so we can all

get back to where we were, and start gaining ground again.

w

Posted By: Steven 49er

Re: Silver shot up...... - 07/24/20 11:51 AM

I hope that work outs for us all, I'm not as confident Trump winning the election will turn things around. I'm of the belief the Fed and their free money policies of the last 20 years has done too much damage.

Posted By: Dave Kimball

Re: Silver shot up...... - 07/24/20 12:15 PM

I'd feel like an idiot paying $1868 for an ounce of gold. That's just me though.

It feels pretty good when you're sitting on a few ounces you bought in 2002 @ $350.00 and ounce. .99999 Canadian

Posted By: SNIPERBBB

Re: Silver shot up...... - 07/24/20 01:14 PM

How is BITCOIN doing ?

Are you mega-rich yet ?

w

It's up about 600 this week though down about 2700 from this time last year. Still 50% higher than when I purchased. Some of the "penny" cryptos are up 3x from a few months ago. Litecoin has pretty much stayed flat and never really recovered from the big run and crash two years ago.

Posted By: bbasher

Re: Silver shot up...... - 07/24/20 01:29 PM

Steve49, what's your plan? The financial markets collapse, and the dollar has no value, what good is investing going to do you?

Posted By: NonPCfed

Re: Silver shot up...... - 07/24/20 05:13 PM

I hope that work outs for us all, I'm not as confident Trump winning the election will turn things around. I'm of the belief the Fed and their free money policies of the last 20 years has done too much damage.

Especially with another 5 trillion in fed debt by the time all the covid spending is tallied up.

Posted By: Steven 49er

Re: Silver shot up...... - 07/27/20 12:32 AM

Steve49, what's your plan? The financial markets collapse, and the dollar has no value, what good is investing going to do you?

My plan is to have some insurance. If the dollar crashes there will be value in other venues whether it be metals, real estate or foreign markets. Don't forget lead and brass.

The price of gold is pennies away from it's all time high, with all the quantitative easing going in there isn't much to stop it from going quite a bit higher. Silver should close the GSR gap .

Walleyed, keep an eye on bitcoin, its going go for a heck of a roller coaster ride.

Posted By: Bison88

Re: Silver shot up...... - 07/27/20 03:33 AM

Looking like another good day!

Posted By: Steven 49er

Re: Silver shot up...... - 07/27/20 05:03 AM

Wait until the markets open in the morning, it will be interesting to see how much the silver miners go up. As I type this gold is at 1932, all time high. Parker and Tony should make some money this summer if they can get fired up.

Posted By: Larry Hall

Re: Silver shot up...... - 07/27/20 02:00 PM

Silver miners and all PM miners looking pretty sharp this morning.. AG is on fire and will probably continue on up.. 20% short position in the market against them currently..Guy could make some money on this one or lose their ever loving butts!!! They settle their tax dispute favorably with the Mexican government, watch out..

Posted By: SNIPERBBB

Re: Silver shot up...... - 07/27/20 02:06 PM

Bitcoin is now up 600 from last week

Posted By: rex123

Re: Silver shot up...... - 07/27/20 04:37 PM

Silver is over 24 today.

Posted By: Steven 49er

Re: Silver shot up...... - 07/27/20 11:29 PM

Over $25 now.

Posted By: rex123

Re: Silver shot up...... - 07/28/20 12:24 AM

A buyer told me that he thought it would go up until fall. Can't decide to sell or wait a few weeks?

Posted By: TRAPPER-ED

Re: Silver shot up...... - 07/28/20 03:46 AM

reports i have heard say its good for 6 to 10 months ? will see ? some one last year on here posted buy ELA i looked at it and got 100 shares for 96 cents a share i have been up over 500 % at one time its down some now i did sell 50 shares , been buying in to mining companies mainly silver like AG and AUY and others

Posted By: Larry Hall

Re: Silver shot up...... - 07/28/20 12:22 PM

looks like the big time traders intervened in both Gold and Silver over the evening hours.. Those $21 and $18.50 buy points just may happen on silver in the next couple of weeks.. I see Goldman Sachs just raised their target price on gold to $2300 an ounce and $30 on silver..Unfortunately the downside to all this is the dollar is probably broken and we as Americans probably have some difficult times ahead.. I recall the late 70's and early 80's.. Car note was 15-17%, house mortgage was 12ish as i recall.. Unbelievable.. Makes it hard to be young, dumb and starting out like I was..

Posted By: NonPCfed

Re: Silver shot up...... - 07/31/20 12:08 PM

Yeah, I remember even higher interest rates. A guy I knew about a brand new crappy little compact care "Horizon"...?) in the fall of 1982 and his note was 19.95%. Then again, he probably had either no credit or had screwed up his first few credit purchases and whacked his credit score. Needless to say, he never paid off that car. A pharmacist I used to know was fresh out of school and just married and they had a house note at 18%. He said after a couple years, they owed more than what they started with the loan. Luckily, "Morning in America" end of Reagan's first term or early in his 2nd, housing around here was moving again and value going up so the pharmist and his wife got out of their crappy house deal and moved up. Our current housing industry would collapse if interest rates went back up pushing 10%!!!!

Posted By: white17

Re: Silver shot up...... - 07/31/20 02:08 PM

Looks like there are opposing views at Goldman.

Gold has ‘no role’ in portfolio of wealthy clients, says Goldman manager Don’t believe the hype.

That’s the message from Sharmin Mossavar-Rahmani, chief investment officer of private wealth management at Goldman Sachs, who thinks that gold is overpriced and has no clear role in the portfolios of her private clients.

Our view is that gold is only appropriate if you have a very strong view that the U.S. dollar is going to be debased. We don’t have that view. We think the dollar maintains its status as the reserve currency. The dollar can cheapen a little bit because it’s moderately overvalued but that doesn’t mean that it’s going to be debased, that we are going to have huge inflation and that gold is a good substitute.

During an interview on CNBC Thursday morning, Mossavar-Rahmani explained that her wealth management group has two factors that it focuses on when thinking about gold: strategically and tactically.

She said that gold isn’t a great deflation hedge, doesn’t generate any income, and isn’t tied to economic growth and corporate earnings, so it fails the strategic hurdle as Goldman’s wealth management crew assesses its relevance in a balanced portfolio.

Secondly, she explained that tactically, gold is a hard case to make unless investors hold the perception that the current bout of weakness in the U.S. dollar is the start of a more severe downturn for dollars and a possible change in leadership of the monetary unit that is viewed as the No. 1 reserve currency in the world.

“So all this excitement and brouhaha about gold is not something that we buy into,” Mossavar-Rahmani said.

“In fact, at one point, we think people should look at the reverse and think there’s more downside to gold,” she said.

Mossavar-Rahmani’s comments run in contrast with Goldman’s commodity crew, which earlier this week raised its 12-month forecast for gold to $2,300 from $2,000 .

That shift was precipitated by “a potential shift in the U.S. Fed toward an inflationary bias against a backdrop of rising geopolitical tensions, elevated U.S. domestic political and social uncertainty, and a growing second wave of COVID-19 related infections,” said a team of analysts including Jeffrey Currie.

On Thursday, August gold GOLD, 0.88% fell by $11.10, or 0.6%, to settle at $1,942.30 an ounce, after settling at a record on Wednesday, marking its ninth straight advance, which is its longest win streak since a 10-session climb ended in January.

Gold’s ascent has come amid the backdrop of rising cases of COVID-19 in the U.S. and around the world. However, gold’s climb has also coincided with a weakening of the dollar against its major rivals, which can give gold buoyancy because bullion and other precious metals are priced in the currency and its softening can make metals more attractive to buyers using alternative currencies.

One measure of the buck, the ICE U.S. Dollar Index DXY, 0.14% was down around its lowest level since 2018 and has dropped 4.5% so far in July, according to FactSet data, while gold has climbed 8.1%, based on the most-active contract.

https://www.marketwatch.com/story/g...oldman-manager-11596138456?mod=hp_LATEST

Posted By: SNIPERBBB

Re: Silver shot up...... - 07/31/20 02:23 PM

Did they say that as they were about to buy a bunch of gold like they do with everything else?

Posted By: Steven 49er

Re: Silver shot up...... - 07/31/20 02:28 PM

Sharmin probably went to a college that teaches modern monetary theory.

Gold isn't going to stop at 2300 and silver will set new highs.

Our housing market would crash if interest rates went to 5 percent, we are in a bubble. The bubble popped in 2008 and the solution by the FED and the US government was to increase that bubble many times over.

Posted By: white17

Re: Silver shot up...... - 07/31/20 02:39 PM

Did they say that as they were about to buy a bunch of gold like they do with everything else?

I have always suspected GS of doing things like that.

Curious here Steven: You mentioned a couple days ago that you expect to see deflation before inflation.......I agree with that.

IF that is true, shouldn't we see metals prices decline ?

Posted By: Rat Masterson

Re: Silver shot up...... - 07/31/20 03:22 PM

We would see most prices decline, no?

Posted By: white17

Re: Silver shot up...... - 07/31/20 03:28 PM

I would certainly think so

Posted By: SNIPERBBB

Re: Silver shot up...... - 07/31/20 03:31 PM

By rights I think we should be seeing deflation now but there is so much manipulation by the fed that it can't happen . The normal rules of the markets have been dammed up. Eventually that dam will break and the downstream effects will be much worse than if the normal flow would of occured.

Posted By: cfowler

Re: Silver shot up...... - 07/31/20 04:26 PM

Price above spot, for physical Au and Ag, indicates a price increase is anticipated by major dealers. 1oz Eagles in either metal are expected to be in short supply, with a larger premium.

Stackers in some sectors anticipate a price drop after this surge. Some are selling top-end pieces, with a large percent over metals price. They sell high, buy low, make the stack grow.

Locally, shops are offering more, if you’re selling, because turn-around has picked up.

If you happened to purchase earlier in this year, you’re all

Posted By: Steven 49er

Re: Silver shot up...... - 07/31/20 06:09 PM

Did they say that as they were about to buy a bunch of gold like they do with everything else?

I have always suspected GS of doing things like that.

Curious here Steven: You mentioned a couple days ago that you expect to see deflation before inflation.......I agree with that.

IF that is true, shouldn't we see metals prices decline ?

Ken did I say deflation before inflation? I think I said hyperinflation lol. I expect, and I hope for the sake of our youth that I'm wrong, we'll see inflation levels beyond the 70s and early 80s.

Anyhow, should metal prices decline if we see inflation? Let me ponder that for a bit and see if i can best express my feelings.

Posted By: white17

Re: Silver shot up...... - 07/31/20 06:24 PM

No. My question was.....if we experience deflation shouldn't metals prices decline ?

Yes, that's right. You said ....."We'll see deflation before hyperinflation." On the recession thread

Posted By: Steven 49er

Re: Silver shot up...... - 07/31/20 09:37 PM

Ken, after some pondering over it, I've come up with three theories of mine.

1). I expect we will see some downward pressure on silver in the coming months. In winter of 08 silver went to a hair over $20, by late summer early fall is was below 10 dollars. By 2011 it was almost $50 an ounce. That is what I expected to happen during when the next economic down turn hit and still can. If silver goes back below 20 I'm backing up the truck.

2). Silver was trading around $17 in early March and then fell to the $12 range for a short period. It could be that was the deflation we were going to experience and the policies of the FED which is true inflation caused the market to rise.

3). This recession is a continuation of the 2008 recession and deflation you speak of happened the last few years and now silver is in inflationary mode.

Notice I haven't used the term hyperinflation yet in relation to metals. I think gold and silver havent even warmed up yet, maybe in the stretching phase.

My above 3 scenarios doesn't pertain to gold so much. IMHO gold is the true form of money and is reacting accordingly to the inflationary policies set forth by central banksik

Of those scenarios, I that #1 is most likely followed by 3.

Posted By: Marty

Re: Silver shot up...... - 07/31/20 09:39 PM

Was not $50 ounce due to a person/persons trying to corner the market?

Posted By: Steven 49er

Re: Silver shot up...... - 07/31/20 09:55 PM

Not in 2011 when silver went north of 40 and gold set and all time high.

You are referring to when the Hunts tried to corner the market in 1980 and silver went from the $4 range to almost $50. Even after the Comex and the government changed the rules that all but bankrupted the brothers silver trended 2 to times plus or minus higher for 3 years or so. We all know what inflation was like in 1980

Posted By: Steven 49er

Re: Silver shot up...... - 07/31/20 10:01 PM

Also Ken, I don't think the play is in metals at these price points although I think 24 dollar silver would be a good entry level. Since silver broke the $20 level I think the move is in mining stock

Posted By: TRAPPER-ED

Re: Silver shot up...... - 08/02/20 03:05 AM

I got stock in SILV up 79% ,FCX up 51%,WRN up 31%, AG and BTG are 26% , AUY 21% and 3 new ones i just got KGC ,IAU, and LMSDF is only 70 cents a share which 2 stock advisers was high on ,

Posted By: Steven 49er

Re: Silver shot up...... - 08/06/20 10:04 PM

No sign of slowing down.

Posted By: rex123

Re: Silver shot up...... - 08/06/20 11:27 PM

If it is this high tomorrow I am selling some.

Posted By: Steven 49er

Re: Silver shot up...... - 08/06/20 11:35 PM

I wouldnt.

Posted By: petehall

Re: Silver shot up...... - 08/06/20 11:43 PM

Your good ,let it Ride !!!!

Posted By: larrywaugh

Re: Silver shot up...... - 08/06/20 11:54 PM

Why is it when I Google silver spot price its 28.96 but jm bullions website says 29.86.

Posted By: cfowler

Re: Silver shot up...... - 08/06/20 11:55 PM

If it is this high tomorrow I am selling some.

Me neither!

Posted By: Sprung & Rusty

Re: Silver shot up...... - 08/07/20 12:58 AM

Why is it when I Google silver spot price its 28.96 but jm bullions website says 29.86.

Was the market still opened when you checked it?

Posted By: timbremn

Re: Silver shot up...... - 08/07/20 01:23 AM

Why is it when I Google silver spot price its 28.96 but jm bullions website says 29.86.

Because when you buy silver at retail you are always going to pay over spot. When you sell, you should get spot. The dealers make their money on the spread.

Posted By: JD Hornet

Re: Silver shot up...... - 08/07/20 01:32 AM

A lot of people on here have stated metal is a bad investment. When it is a good investment it is to late to buy. Just like the stock market. Metal is for long term. Silver has been making a dollar a day for a few days now. Gold is to the moon. 49er is correct rex. Played this game in early 2000's hold on it's going like a rocket ship and it is all engineered just like the stock market.

Posted By: JD Hornet

Re: Silver shot up...... - 08/07/20 01:33 AM

A lot of people on here have stated metal is a bad investment. When it is a good investment it is to late to buy. Just like the stock market. Metal is for long term. Silver has been making a dollar a day for a few days now. Gold is to the moon. 49er is correct rex. Played this game in early 2000's hold on it's going like a rocket ship and it is all engineered just like the stock market.

Posted By: timbremn

Re: Silver shot up...... - 08/07/20 01:34 AM

Nothing wrong with selling a little on the way up to the moon

Posted By: JD Hornet

Re: Silver shot up...... - 08/07/20 01:36 AM

Nothing wrong with a smart investment and making money Tim. I pray you do well!

Posted By: white17

Re: Silver shot up...... - 08/07/20 01:50 AM

Nothing wrong with selling a little on the way up to the moon

No one ever lost money taking a profit. You might leave some on the table but I'd rather do that than lose.

Posted By: charles

Re: Silver shot up...... - 08/07/20 01:55 AM

I bought two 100 oz bars at, drum roll please, $4 per ounce after it fell from the $32 range. Still a lousy investment over 35 years of holding. Most any good stock would have beaten it. I add a little every year but only in 1oz coins now.

Posted By: charles

Re: Silver shot up...... - 08/07/20 02:28 AM

I would consider selling over $30 and would pull the trigger over $40. Patience, greed, and ignorance are my ventures.

Posted By: Larry Hall

Re: Silver shot up...... - 08/07/20 01:08 PM

Certainly interesting times here.. I'm mostly on the side lines now in the metals paper market, both metal and miners. Weds was my day to say the heck with it and take profits.. Hoping for that pull back like everyone else now LOL.. $24/25 is the dream number to reenter I suppose. This has become quite an interesting little trade the last few months..Been a heck of a lot more productive than fur trapping or hunting.. I find it interesting that more than a few Trappers are fairly actively engaged in the PM market as the average investor doesn't have a clue and the market is so tiny. Some similarities to the Trapper numbers I guess...Good luck to ya all..

Posted By: Steven 49er

Re: Silver shot up...... - 08/07/20 01:19 PM

Nothing wrong with selling a little on the way up to the moon

No one ever lost money taking a profit. You might leave some on the table but I'd rather do that than lose.

Why is it when I Google silver spot price its 28.96 but jm bullions website says 29.86.

Was the market still opened when you checked it?

Silver market is open from Sunday 6 pm eastern time to Friday 5 pm eastern, also they close Monday through Thursday from 5 to 6 pm eastern. It's a global market

I wouldn't sell my metals right now, profit or no profit, the dxy market isn't done falling yet, not by a long shot. I'd maybe consider selling miners but then I'd take the profit and buy more physical.

Posted By: Steven 49er

Re: Silver shot up...... - 08/07/20 02:24 PM

Looks like there is some profit taking going on today.

No worries, it's a good thing.

Posted By: cfowler

Re: Silver shot up...... - 08/07/20 02:45 PM

I doubt if today’s paper sell-off and price drop will drop the price in the physical market as much, unless you’re selling.

Posted By: TRAPPER-ED

Re: Silver shot up...... - 08/08/20 02:15 AM

you need to watch the Kendall report ever morning , bob knows his stuff , he will tell you what he thinks is going to happen , most always right ,he says it looks like prices of gold and silver will stay high for 6-10 months ? HE is on you tube also

Posted By: Sprung & Rusty

Re: Silver shot up...... - 08/08/20 02:37 AM

How high is it going to go?

Posted By: Steven 49er

Re: Silver shot up...... - 08/08/20 03:26 AM

Higher!

Posted By: Starbits

Re: Silver shot up...... - 08/08/20 04:06 AM

How high is it going to go?

It is going to go to 1$ below your sell point and then drop to 1$ above your buy point.

Posted By: Rat Masterson

Re: Silver shot up...... - 08/08/20 04:19 AM

As soon as there is a vaccine, which could be in October, metals will drop. This info is worth what you paid for it.

Posted By: Steven 49er

Re: Silver shot up...... - 08/08/20 09:45 AM

Do you think the money creation will stop just because there is a vaccine?

Posted By: cfowler

Re: Silver shot up...... - 08/08/20 01:03 PM

Do you think the money creation will stop just because there is a vaccine?

Fiat currencies are being “printed” at records amount throughout the world. The IMF is talking about a “global reset”. Currency devaluation and market manipulation is in full effect. Bank of America forecast gold at $3000 and silver at $50. JP Morgan has a similar forecast.

Social/political unrest will drive the price up as we move towards the election. That’s my guess.

The “vaccine” is about “control”. IMO

Posted By: Sprung & Rusty

Re: Silver shot up...... - 08/08/20 01:23 PM

How high is it going to go?

It is going to go to 1$ below your sell point and then drop to 1$ above your buy point.

Lol

Posted By: danvee

Re: Silver shot up...... - 08/08/20 01:29 PM

I have some solid gold necklaces I bought in Thailand in 1968 for I think about $30 bucks a ounce worth a lot more now, but given the amount of time I would have done better having that money in the stock market.

Posted By: Steven 49er

Re: Silver shot up...... - 08/11/20 08:07 PM

PM prices are taking a thumping today. It's expected.

Posted By: white17

Re: Silver shot up...... - 08/11/20 08:09 PM

10 year treasury oooched up a bit. Rumor of no more stimulus. Tanked the market too.

Posted By: cfowler

Re: Silver shot up...... - 08/11/20 08:52 PM

PM prices are taking a thumping today. It's expected.

Totally expected. Where the bottom will be is a question. The next run up will reach quite a bit higher I believe.

Posted By: .204

Re: Silver shot up...... - 08/11/20 08:54 PM

I'll be patiently waiting!

Posted By: Steven 49er

Re: Silver shot up...... - 08/11/20 09:00 PM

10 year treasury oooched up a bit. Rumor of no more stimulus. Tanked the market too.

No more? There will be multiple more.

Posted By: Furvor

Re: Silver shot up...... - 08/11/20 09:56 PM

There is no shortage of silver. Bank vaults will be mined.

Posted By: SNIPERBBB

Re: Silver shot up...... - 08/12/20 12:23 AM

Cryptos took a hit today as well. Might of been a good bit of profit taking though.

Posted By: Hydropillar

Re: Silver shot up...... - 08/12/20 12:54 AM

ill use a phrase i see the stock market guys use.... buy on the dips..... anything real is going higher imho

Posted By: Larry Hall

Re: Silver shot up...... - 08/12/20 12:30 PM

Interesting move in the paper silver markets today.. Some folks are saying 4-7 weeks period of fluctuation/consolidation before we hit the lows and see the next big move up.. We will see

Posted By: white17

Re: Silver shot up...... - 08/12/20 12:38 PM

10 year treasury oooched up a bit. Rumor of no more stimulus. Tanked the market too.

No more? There will be multiple more.

I agree.............eventually.

Posted By: white17

Re: Silver shot up...... - 08/12/20 12:58 PM

Interesting move in the paper silver markets today.. Some folks are saying 4-7 weeks period of fluctuation/consolidation before we hit the lows and see the next big move up.. We will see

What do you think could drive a move upward ?

Posted By: Larry Hall

Re: Silver shot up...... - 08/12/20 03:15 PM

White17, further breakdown in the USD long term, but the real driver is the trillions of digital dollars created by the fed so far and the trillions more to follow. My opinion anyways, based on following some folks way smarter than me.. Jim Grant has some excellent info available that can be tapped by Joe Average without spending a bunch of money.. FWIW.

Posted By: white17

Re: Silver shot up...... - 08/12/20 05:51 PM

Jim Grant is great !!

On the other hand, look at the yield on the 10 year treasury. That is sending the message that inflation in real terms is nowhere to be seen for at least the next decade.

Confusing times .

Posted By: SNIPERBBB

Re: Silver shot up...... - 08/12/20 06:30 PM

Jim Grant is great !!

On the other hand, look at the yield on the 10 year treasury. That is sending the message that inflation in real terms is nowhere to be seen for at least the next decade.

Confusing times .

Who is buying those t-bills? If it's whoi think it is they're overly optimistic. Would love to be wrong though.

Posted By: Chancey

Re: Silver shot up...... - 08/12/20 06:30 PM

Thanks for mentioning Jim Grant Larry Hall and white 17!

I had never heard of Jim Grant so I looked him up and found this video on youtube from 2 weeks ago. He talks about gold/silver prices and inflation/deflation.

Jim Grant Interview

Posted By: white17

Re: Silver shot up...... - 08/12/20 06:41 PM

Jim Grant is great !!

On the other hand, look at the yield on the 10 year treasury. That is sending the message that inflation in real terms is nowhere to be seen for at least the next decade.

Confusing times .

Who is buying those t-bills? If it's whoi think it is they're overly optimistic. Would love to be wrong though.

The rest of the world. US Treasuries are stll the safest port in the storm worldwide.

Capital fleeing places like Brazil & Hong Kong are coming here and into 'risk free' securities.

Posted By: SNIPERBBB

Re: Silver shot up...... - 08/12/20 06:54 PM

Rest of the world? My understanding is 95% is being bought by the Fed. And most of the auctions the Fed is the only buyer.

Posted By: white17

Re: Silver shot up...... - 08/12/20 06:58 PM

Of course a lot of it is but we're talking trillions of dollars of new issues coming on the market on a regular basis. The Fed isn't going to absorb all of that. There is demand from all over the world. If the best you can do in say the UK is a negative 2% you will gladly take 0% or a negative 0.5 % in US notes & bonds

Posted By: Larry Hall

Re: Silver shot up...... - 08/12/20 10:42 PM

You are welcome Chancey, I’ve been a follower of his for years, class act without a hatchet/agenda driving his content. Take a peak at Bill Fleckenstien as well. I subscribed to his service for years and he is the one who turned me onto Jim Grant.

White17. Ultimately aren’t the high yields creating a huge problem for the Fed? I mean their end game has to to deflate all this recently printed money into oblivion down the road doesn’t it? Look at a $20 Bill today vs 1970. Take a whole pile of today’s $20 bills to buy the same Amount of products one would back then. Don’t “they” have to force yields down to achieve that end?

Ultimately if you’ve got some hard assets and keep money invested in quality companies and a bit of precious metals I think a person can survive the upcoming debacle. But man I would hate to be starting out, poor, dumb and uneducated in the future like I did starting out. Believe it would be darn near impossible to scale the wall to middle class, let alone any aspirations of something higher.

Posted By: Steven 49er

Re: Silver shot up...... - 08/12/20 11:17 PM

[

No more? There will be multiple more.

I agree.............eventually.

Eventually is pretty open ended. I'd wager we'll see three in the next year

Posted By: white17

Re: Silver shot up...... - 08/13/20 01:43 AM

You are welcome Chancey, I’ve been a follower of his for years, class act without a hatchet/agenda driving his content. Take a peak at Bill Fleckenstien as well. I subscribed to his service for years and he is the one who turned me onto Jim Grant.

White17. Ultimately aren’t the high yields creating a huge problem for the Fed? I mean their end game has to to deflate all this recently printed money into oblivion down the road doesn’t it? Look at a $20 Bill today vs 1970. Take a whole pile of today’s $20 bills to buy the same Amount of products one would back then. Don’t “they” have to force yields down to achieve that end?

I agree Larry. Jim Grant does not seem to have an agenda and lives up to the name of his news letter. I have been reading Grant's Interest Rate Observer for many years. I know it probably sounds boring to a lot of folks but I find it fascinating. And the subject matter has a huge impact on people's well being.

It does take a whole pile of 20's today compared to what one 20 would buy in the 1970's

But..........NO........"they" don't have to force yields DOWN. They have to force yields UP in order to control any future inflation. Unfortunately for the Fed they really have hardly any room to move. They would love to "normalize" rates into the 3-5% range but they don't dare even mention that. As soon as they try something like that the credit markets will seize up and the stock market will tank.

They have themselves between a rock and a hard place. That's why sometime last week I predicted we will see the fed actually pegging yields on specific maturities rather than letting the market set those rates. In other words they will manipulate the yield curve to TRY to prevent the market from pushing long rates even lower.

We have lived through.... and still are....a real anomaly where inflation is concerned. When the Fed responded to the Financial Crisis in 2008, we all expected to see prices and inflation rise. But that didn't happen. Rather than those hundreds of billions of dollars going into consumption of goods & services they ended up in the stock market.

The Fed wanted to push asset prices up so that folks would feel more wealthy and spend more. That didn't happen. Asset prices just went up and people changed their behavior. That is one thing the Fed can't control.

We were happy to put our new-found dollars into the market. To heck with buying a new truck for your wife or a new house for your girlfriend. The fed has been fighting that battle ever since and that is why we have not seen the inflation that we would expect in normal times.

The fed can create an easy monetary policy but it can't force the banks to loan those dollars or force individuals to borrow or spend. Unless the velocity of those dollars increases, we are not likely.........IMO.........to see inflation to any significant degree.

I am sure that Jim Grant is correct that gold is not a bad thing to have in your portfolio at this time. But the real question is...in my mind........... for how long do I need to hold this non-producing metal ??

A stopped clock is right twice a day ,so eventually gold will be a good thing to have...........for a while

But what are the opportunity costs of holding gold as opposed to equities ??

I know I am rambling on here ......

Some pages back on this thread our member charles said he bought silver in 1985 at 4$ per ounce. So one dollar would have bought him a quarter ounce of silver. If we give silver a price today of $25 per ounce......that means that each of his dollars is worth $6.25 today.

However, if charles had invested 1 dollar in the S&P 500 in 1985.that same dollar at the end of 2019 would be worth $35.27........over 5 1/2 times as much

Sorry for the book !

Posted By: Steven 49er

Re: Silver shot up...... - 08/13/20 12:43 PM

But..........NO........"they" don't have to force yields DOWN. They have to force yields UP in order to control any future inflation. Unfortunately for the Fed they really have hardly any room to move. They would love to "normalize" rates into the 3-5% range but they don't dare even mention that. As soon as they try something like that the credit markets will seize up and the stock market will tank.

They have themselves between a rock and a hard place. That's why sometime last week I predicted we will see the fed actually pegging yields on specific maturities rather than letting the market set those rates. In other words they will manipulate the yield curve to TRY to prevent the market from pushing long rates even lower.

The FED created the problem when they went to zero percent after the 2008 crisis. I don't see any way out of it for them unless there is significant inflation and more to the point hyperinflation.

Do you envision any way out?

Posted By: Larry Hall

Re: Silver shot up...... - 08/13/20 01:08 PM

White 17 excellent commentary in a clear and concise manner!! I see that banks have really cranked up lending standards to the threshold that if you "need" a loan, no way you can get one loosely paraphrased.. Really amplifies the point you just made about money staying in the wrong hands so to speak and keeping inflation pressures low.

My take on holding the PM's is just like buying home owners insurance or a liability umbrella. It is absolutely a cost with no benefit, unless you need it. You could do far better investing those funds in the stock market over the same time period, unless the unthinkable happens. With the added benefit that you get your "payments" purchase price back and possibly some gain should you ever decide to cash it in. The unfortunate fact that in today's world we live with the very real possibility of a financial market implosion.. I think since 2009 the risks have elevated far above what they were in the decades prior when more of a normal market and governmental environment existed.. Now we seem to be approaching the extreme end of the pendulum from a financial market and political stand point.. Risk is extremely high of some unforeseeable, horrible event happening in either arena.. A small portion of your portfolio tucked away into physical PM's and some solid producers is for me an insurance policy..Helps me sleep at night FWIW..

Posted By: white17

Re: Silver shot up...... - 08/13/20 01:16 PM

But..........NO........"they" don't have to force yields DOWN. They have to force yields UP in order to control any future inflation. Unfortunately for the Fed they really have hardly any room to move. They would love to "normalize" rates into the 3-5% range but they don't dare even mention that. As soon as they try something like that the credit markets will seize up and the stock market will tank.

They have themselves between a rock and a hard place. That's why sometime last week I predicted we will see the fed actually pegging yields on specific maturities rather than letting the market set those rates. In other words they will manipulate the yield curve to TRY to prevent the market from pushing long rates even lower.

The FED created the problem when they went to zero percent after the 2008 crisis. I don't see any way out of it for them unless there is significant inflation and more to the point hyperinflation.

Do you envision any way out?

No I don't but I am not as smart as a lot of those people.

Posted By: white17

Re: Silver shot up...... - 08/13/20 01:22 PM

White 17 excellent commentary in a clear and concise manner!! I see that banks have really cranked up lending standards to the threshold that if you "need" a loan, no way you can get one loosely paraphrased.. Really amplifies the point you just made about money staying in the wrong hands so to speak and keeping inflation pressures low.

My take on holding the PM's is just like buying home owners insurance or a liability umbrella. It is absolutely a cost with no benefit, unless you need it. You could do far better investing those funds in the stock market over the same time period, unless the unthinkable happens. With the added benefit that you get your "payments" purchase price back and possibly some gain should you ever decide to cash it in. The unfortunate fact that in today's world we live with the very real possibility of a financial market implosion.. I think since 2009 the risks have elevated far above what they were in the decades prior when more of a normal market and governmental environment existed.. Now we seem to be approaching the extreme end of the pendulum from a financial market and political stand point.. Risk is extremely high of some unforeseeable, horrible event happening in either arena.. A small portion of your portfolio tucked away into physical PM's and some solid producers is for me an insurance policy..Helps me sleep at night FWIW..

I think that's a great analogy Larry. If viewed as an insurance cost rather than an investment, then PM's make good sense

Posted By: cfowler

Re: Silver shot up...... - 08/13/20 02:23 PM

LOT of good conversation, with different views and insights. PM’s as an insurance policy is a very good analogy. The FED has pulled a lot of rabbits outta the hat, so it wouldn’t surprise me to see another. A FED that says “we’ll do whatever it takes”, brings to mind negative rates and hyperinflation. Jerome Powell talks outta both sides of his neck.

Posted By: Larry Hall

Re: Silver shot up...... - 08/13/20 03:27 PM

Heck of an interesting thread and some excellent commentary from numerous folks on a TRAPPING board.. Who'da thunk it? LOL The Robin Hood and Reddit gang would lose their minds if they read this.

Posted By: rex123

Re: Silver shot up...... - 08/13/20 03:32 PM

Why? Opinions are a dime a dozen. Everyone has one.

Posted By: Steven 49er

Re: Silver shot up...... - 08/13/20 06:03 PM

LOT of good conversation, with different views and insights. PM’s as an insurance policy is a very good analogy. The FED has pulled a lot of rabbits outta the hat, so it wouldn’t surprise me to see another. A FED that says “we’ll do whatever it takes”, brings to mind negative rates and hyperinflation. Jerome Powell talks outta both sides of his neck.

Bernanke, Powell's predecessor, said they would drop helicopters full of cash to stave off deflation if that is what it takes.

5 percent cut in GDP annualized in Q1, 33 percent in Q2. Is deflation coming?

Posted By: cfowler

Re: Silver shot up...... - 08/13/20 11:47 PM

Powell stated back in May that deflation was a bigger concern than inflation for the near term. In July he said that, aside from food prices, everything was dropping in price. The FED is well below the 2% inflation rate it would like to maintain. If the FED ties a rise in interest rates to inflation, as many speculate they will, possibly announcing such in September, things could get interesting. If we’re to believe Powell, we’re in a deflationary period now, with near zero interest rates. It seems, according to the FED, that, we need more liquidity to create inflation (more people with more dollars to spend). QE to infinity, the FED solution, is a death spiral IMO. Too much of our GDP is in the service sector. Aside from a few areas, we’re no longer a nation producing goods for ourselves and for export to others. You can’t really sustain an economy without producing goods. A collapse of the dollar seems likely since so much of the spending that goes on today is actually debt.

Is deflation coming? It may already be here. Powell says he’s looking for a rise in inflation in the coming months.

Like to read your thought Steven.

Posted By: Steven 49er

Re: Silver shot up...... - 08/14/20 02:49 AM

cfowler, I don't believe we are in a deflationary period yet.

Too much free money floating around.

Posted By: white17

Re: Silver shot up...... - 08/14/20 03:43 AM

I would say the probability of a rate increase in September is less than zero. And not much higher than that in September 2021.

Posted By: cfowler

Re: Silver shot up...... - 08/14/20 04:23 AM

cfowler, I don't believe we are in a deflationary period yet.

Too much free money floating around.

I agree that there’s too much free money floating around, thus there has not been a real reduction in prices for the average consumer. However, if you’re in commercial real estate, prices have dropped. If you’re buying gas, the price remains below $2 a gallon in many areas. If you’re refinancing your house, or getting a new home loan, interest rates are pretty low. Aside from a few examples, I can’t see any real deflation has occurred.

How will we reach a deflationary period if the FED continues to inject dollars into the economy? The dollar will eventually lose value, resulting in it taking more dollars to purchase the same item. Money printing should create inflation, in that there’s more dollars competing for the same items.

What will it take to reach deflation in your opinion? As White said, the FED is between the rock and a hard place. If they raise interest rates, the markets fall. We need real economic recovery on Main Street, not just Wall Street. To achieve that, we’re gonna have to embrace capitalism again. Intervention economics isn’t getting it done for the average American.

Posted By: cfowler

Re: Silver shot up...... - 08/14/20 01:36 PM

I would say the probability of a rate increase in September is less than zero. And not much higher than that in September 2021.

I don’t believe there will be a rate increase in September. There are those who believe after the FED’s meeting in September, they will announce, they are pegging the rate to inflation. May be a pipe dream, but they have to come up with some way to have inflation, a rate increase, and not crash the market. The FED is a financial contortionist, so they may come up with something. Or perhaps they’re just waiting on the IMF Global Reset.

Posted By: Dirt

Re: Silver shot up...... - 08/14/20 02:29 PM

"What are the Federal Reserve's objectives in conducting monetary policy?

The objectives as mandated by the Congress in the Federal Reserve Act are promoting (1) maximum employment, which means all Americans that want to work are gainfully employed, and (2) stable prices for the goods and services we all purchase. "

Don't see propping up the Stock market on the list?

Posted By: white17

Re: Silver shot up...... - 08/14/20 02:52 PM

"What are the Federal Reserve's objectives in conducting monetary policy?

The objectives as mandated by the Congress in the Federal Reserve Act are promoting (1) maximum employment, which means all Americans that want to work are gainfully employed, and (2) stable prices for the goods and services we all purchase. "

Don't see propping up the Stock market on the list?

But by keeping the credit markets liquid they manage to keep at least a few people employed.

I don’t believe there will be a rate increase in September. There are those who believe after the FED’s meeting in September, they will announce, they are pegging the rate to inflation. May be a pipe dream, but they have to come up with some way to have inflation, a rate increase, and not crash the market. The FED is a financial contortionist, so they may come up with something. Or perhaps they’re just waiting on the IMF Global Reset.

Last week the Fed stated that they are formalizing a policy to allow inflation to run hotter than their 2% target, for a longer period before responding. So if they could ever manage to get inflation up to 2 or even 3% they may not respond for several months.

That is not going to happen any time soon without a vaccine or a therapy for the virus......IMO

Posted By: Larry Hall

Re: Silver shot up...... - 08/15/20 01:53 AM

White 17.

Did you happen to see Warren Buffets comments on the Fed being forced to peg the yield curve to manage the yield? LOL. You called that spot on. Concurrently BH purchased Barrick Gold (at least a major piece of them) as well today.

Believe the precious metals thesis as protection from incredible money printing and manipulation might have just gone mainstream.

You other gents with a significant position already in hand might be very happy with them in a year or two. I’m pretty happy with my insurance policy so far in 2020.

Interesting stuff!

Posted By: white17

Re: Silver shot up...... - 08/15/20 02:34 PM

No I didn't see that Larry. I'm sure Buffett has his fingers on J Powell's pulse !! Come to think of it, it might be the other way around

BH has a huge bond portfolio. I wonder if WB would prefer to see yields continue dropping ?

Did he have any other comments along those lines ?

Posted By: Hydropillar

Re: Silver shot up...... - 08/15/20 02:50 PM

would buffet have to disclose if he was purchasing physical ??

Posted By: white17

Re: Silver shot up...... - 08/15/20 04:59 PM

would buffet have to disclose if he was purchasing physical ??

I don't know. Probably because the SEC would require it of a public company. But he certainly would in the annual report to shareholders.

But That would be very UN-Buffett....... to buy pm's is not even in his wheelhouse.

I read just a bit ago that he has sold all his stake in JP Morgan and Wells-Fargo. Since banks make their money on the spread between short term rates and long term rates........that would imply that he sees rates staying very low for a longtime. On the other hand, he has been increasing his stake in Bank of America. But BAC has been trading below price to book ratio for a while now. That is classic Buffett behavior.

He also bought 20.9 million shares of Barrick Gold..........or at least Berkshire bought them.

I suspect that was NOT a Buffett purchase but one of his two hand picked successors.

Posted By: Steven 49er

Re: Silver shot up...... - 08/15/20 08:20 PM

I also assume that if Bershire purchased physical PM they would have to disclose. BH disclosed they purchased 3500 tons of silver in the nineties and sold in 2006.

WB has typically come out as bearishly gold, more than that, anti physical gold. It surprised me a little that BH bought a stake in a gold mine but not really. They are in the business to make money on value buys and IMHO PM miners stocks were far undervalued in March and April and still are for where I think the metals are going.

If BH announces they purchased a large stake in actual, physical gold, I'll crap my pants and load up on the stuff.

Posted By: Sprung & Rusty

Re: Silver shot up...... - 08/15/20 10:00 PM

Will silver ever pull back under 20 bucks an ounce?

Posted By: Steven 49er

Re: Silver shot up...... - 08/15/20 10:08 PM

It could very well.

Posted By: cfowler

Re: Silver shot up...... - 08/15/20 10:23 PM

Will silver ever pull back under 20 bucks an ounce?

If it does, I’d recommend buying some.

Posted By: Larry Hall

Re: Silver shot up...... - 08/15/20 11:38 PM

White17. I’ve got an interview saved on my twitter feed to watch later with WB. The headlines are he’s recommending not to buy debt currently. I will check it out tomorrow when I get a minute. I suspect J Powell is very responsive to WB Lol. I know WB’s father was a huge proponent of returning to the gold standard and WB has always been a skeptic. Very possibly Barrick was a buy simply due to positive cash flow growth coming down the road due to rising gold prices. If that is the fact, then there are several other far better candidates than Barrick who will be scooped up by other hedge funds. It’s been said Apple could buy the entire silver mining sector with ready cash on hand. Insanely small market.

WB can buy physical and not report it, but any acquisition by BH would have to be disclosed at quarter end. I doubt he would ever acquire outside of BH given his age, track record and estate planning that has been disclosed.

I don’t know if we will see Silver sub $20 again, but it’s very possible. I personally have buy orders placed at $23.50, $21.50 and $18.50 on Silver and $13.50 on the SILJ mining ETF. I believe I will get two of the four buys filled in the next 4-6 weeks. That will fill my PM allotment for the foreseeable future.

49’er. Are you seeing any reduction of premium in the physical market? I’ve not bought any in several years. Just holding what I have.

Have a great weekend all.

Posted By: white17

Re: Silver shot up...... - 08/16/20 12:23 AM

I'd like to watch that interview if you can provide a link.

Posted By: KeithC

Re: Silver shot up...... - 08/16/20 12:57 AM

What price per ounce would you recommend selling silver at? I could use a compact tractor.

Keith

Posted By: Steven 49er

Re: Silver shot up...... - 08/16/20 02:25 AM

Larry, other than a small buy in late April, I haven't purchased physical metals this year. I'm comfortable in my position and I have a daughter starting college this fall, that will put a damper on things lol.

Friend of mine purchased some a week or so ago at the closest dealer, I believe he paid 2.50 over on 10 oz bars. That's a little high, but not much higher than what that store generally charges. On line in terms of dollars the premium is high, in terms of percentages it's pretty close to what it was. Well except for ASE's but that's a supply issue.

I think I've cultivated a connection that will sell me generics for melt and constitutional coinage under plus shipping.

As far as silver going below 20 again, I guess my feeling is why not and it won't surprise me. I believe that metals will retrace 20 to 30 percent at some point before the next big leg up Could be from today's levels that would put it below $20. Or it could be from the $30 level or $40 level. I don't believe it's going straight to the moon. Strong hands will try to drive down prices and shake out the week hands.

I do feel that even at today's levels it's a buy. I think we won't see a v recovery and the FED, foreign CBs and the federal Government will inflate the money supply exponentially more and they will do all they can to suppress an alternative to devalued currencies.

Keith, for me personally it's not for sale at any level. I'm going to wait until the GSR goes below 45 and start trading for gold then we'll see. My advice to you is sell when you feel the price is right, we all have different circumstances and goals.

Larry, I'd like to watch that interview also. Well, not if I need the tweeter to watch it.

If we really want to go down the rabbit hole so to speak what about bitcoin lol.

Posted By: Larry Hall

Re: Silver shot up...... - 08/16/20 02:50 PM

gang, here is the link to the WB clip.. More headline than value, imagine that.. But the shift in WB's stance on the US debt situation is very telling.. Assets that can ride the deflation/inflation waves and produce income throughout are the ticket going forward.. With a bit of PM's tucked back just in case ( I added that last piece, LOL)..https://twitter.com/i/status/1294711729906212864

That link takes you to the twitter version of it, but if you go to Yahoo Finance it's on the front page there as well..

Got my 15 mile bike ride in this morning and am about done for the rest of the day!!!

Posted By: white17

Re: Silver shot up...... - 08/16/20 04:30 PM

Sounds to me as though he will stick with equities and treasuries even though they pay next to nothing.

Bitcoin ??????? NO WAY !!

Posted By: Steven 49er

Re: Silver shot up...... - 08/16/20 07:39 PM

I have just enough bitcoin to say I have some. Why? Because the thought of a decentralized mode of trade intrigues me.

Posted By: cfowler

Re: Silver shot up...... - 08/16/20 09:36 PM

I have just enough bitcoin to say I have some. Why? Because the thought of a decentralized mode of trade intrigues me.

Novelty economics. Gotta love that!

My nephew got in on bitcoin pretty early and made quite a bit through “mining”. I really know nothing about the stuff. Anyways, had a bunch disappear, but stuck with it. Said he had basically nothing in it. His dad told me about a year ago that he was a “millionaire” based on the price then. I know he’s done a lot of overseas traveling, and he says he uses it from time to time in foreign countries and can get more from the exchange rate somehow. I’m more of a physical assets type. I like to see and touch what I’m buying. It’s an intriguing idea though. If I was younger and smarter I might’ve looked into it more.

Posted By: Bob_Iowa

Re: Silver shot up...... - 08/16/20 11:22 PM

Since this thread started I’ve been reading it and have done some looking at physical silver, and I’ve found that “poured bars” have the lowest basis on them compared to “pressed bars” is there any difference besides looks or would they be the same if I was to buy and sell them? They say they are both that 99.99% silver so I would think there are the same.

Posted By: Steven 49er

Re: Silver shot up...... - 08/17/20 12:58 AM

They are the same. If you can find Engelhard poured bars cheaper than pressed let me know.

Personally I think poured bars are cool

Posted By: Bob_Iowa

Re: Silver shot up...... - 08/17/20 01:05 AM

The ones I was looking were on ampex, sd, and jm the first ones that came up on a google search for buying silver online, they all said they would ship whatever they pulled from the vault first with no indication of what you’re going to get but I will keep my eyes open.

Posted By: Steven 49er

Re: Silver shot up...... - 08/17/20 01:53 AM

. Concurrently BH purchased Barrick Gold (at least a major piece of them) as well today.

Larry, I was pondering about BH's announcement. They didn't buy Barrick on Friday, they announced their purchase in their quarterly filing. They bought their position in Barrick in the second quarter. I'd surmise in May. It will be interesting to see if they have added to their position or added other PM positions. It will also be interesting to see how the market reacts tomorrow, will the Robinhooders jump in because of FOMO? On a side note the Asian market has started out down this evening.

Bob, you won't find the poured Engelhard bars with serial numbers cheaper than pressed. They carry a collectible premium. I have a couple that I paid too much for in relation to market value. I'm finally above water on those in relation to melt price. But they are cool to me. Gotta keep it fun to.

Posted By: white17